Global investment firm KKR & Co. (KKR) has agreed to sell Riata Corporate Park to an institutional investor for more than $300 million. The company manages investments across multiple asset classes, including hedge funds, credit, real estate, infrastructure, energy and private equity.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Spanning 688,100 square feet, Riata Corporate Park is an eight-building Class A office campus situated in Northwest Austin, Texas. KKR acquired the property in December 2019 and since then it has substantially upgraded its cafe, fitness center, outdoor amenities, landscaping and other features.

The Partner and Head of Real Estate Acquisitions at KKR, Roger Morales, said, “Our long-term focus on high-quality properties in great locations within attractive growth markets led us to invest in Riata, a tech-focused office campus in one of the country’s most desirable cities. We are proud of the property and capital improvements delivered under our ownership in what has been a very successful pre-pandemic office investment.”

Last month, Oppenheimer analyst Chris Kotowski maintained a Buy rating on the stock and raised the price target to $72 from $65 (14.7% upside potential). (See KKR stock chart on TipRanks)

The analyst said, “KKR is the most underappreciated growth company in the alternative assets sector, and its growth potential is now more and more on display, with investors just beginning to appreciate the story. For more than a decade now, the company has steadily been investing both in terms of its balance sheet financial assets and operationally with now increasingly visible success.”

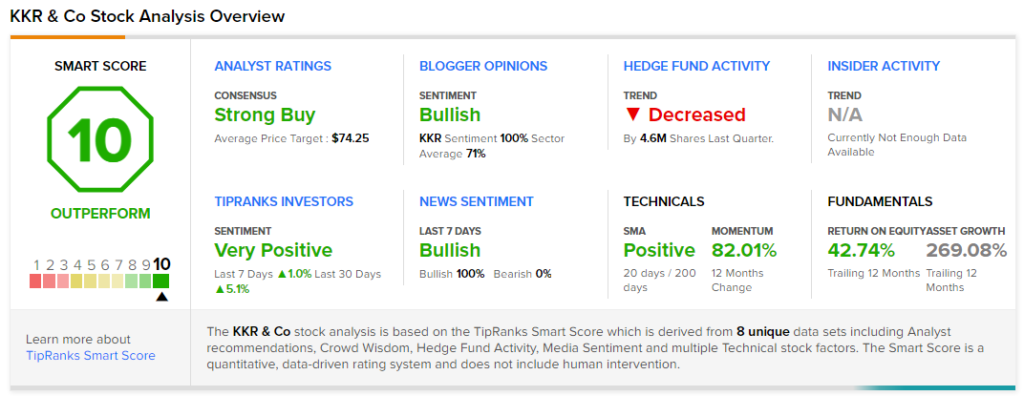

Overall, the stock has a Strong Buy consensus rating based on 7 Buys and 1 Hold. The average KKR & Co. price target of $76.3 implies 21.6% upside potential. Shares of the company have gained 78.4% over the past year.

According to TipRanks’ Smart Score rating system, KKR scores a “Perfect 10,” suggesting that the stock is likely to outperform market averages.

Related News:

What Do Kimco Realty’s Newly Added Risk Factors Tell Investors?

Amazon Front Runner for Multi-Year NFL Sunday Ticket Contract – Report

NMI Holdings Promotes CFO Adam Pollitzer to CEO