Investment firm KKR (NYSE:KKR) targets growth opportunities in Southeast Asia’s digital infrastructure market. In a recent development, the firm announced a $400 million investment in OMS Group, a prominent telecom infrastructure company and provider of subsea cable services. The company expects to complete the transaction by the first quarter of 2024.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

KKR’s latest investment into Southeast Asia’s digital infrastructure market reflects the firm’s strong conviction that digitalization will offer substantial avenues for growth. Projesh Banerjea, who serves as the Director of Infrastructure at KKR, emphasized that the company’s recent investments in Southeast Asia’s digital infrastructure will enable it to capitalize on long-term secular trends like increasing use of data, enterprise demand for cloud services, the government’s focus on digital transformation, and the thriving digital economy.

Earlier in September, KKR made a strategic investment of $800 million to acquire a 20% stake in Singtel’s regional data center business to expand its business across Southeast Asian markets, including Singapore, Indonesia, and Thailand. KKR expects the development and deployment of generative AI (Artificial Intelligence) and the ongoing enterprise shift towards cloud to create significant demand for digital infrastructure. Further, KKR expects Southeast Asia’s data center market to grow faster than the rest of the world.

Thus, to capitalize on the growing demand for digital infrastructure and data centres in Southeast Asia, KKR continues to invest in the region. Previously, KKR invested in Pinnacle Towers, a digital infrastructure platform in Asia. While KKR aims to generate attractive investment returns, let’s look at the Street’s recommendations for KKR stock.

What is the Future of KKR Stock?

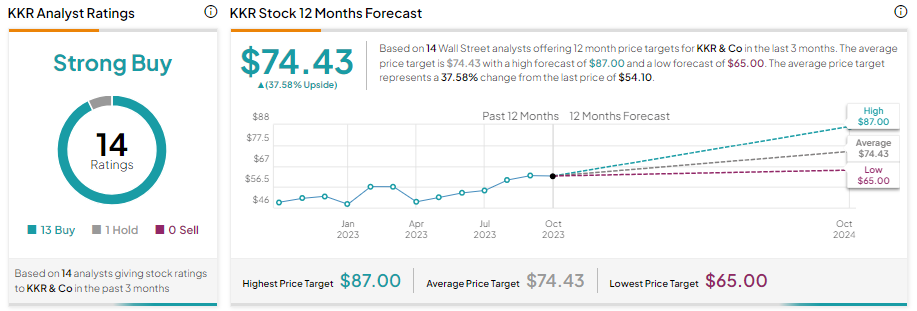

Wall Street analysts continue to show optimism over KKR’s prospects. This also indicates their confidence in the firm’s investment strategy. Overall, with 13 Buys and one Hold recommendation, KKR stock sports a Strong Buy consensus rating. Meanwhile, the average KKR stock price target of $74.43 implies 37.58% upside potential from current levels.