KKR (KKR) has struck a deal to sell aerospace and defense equipment maker Novaria Group to fellow private equity firm Arcline Investment Management for $2.2 billion.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

KKR took control of Texas-based Novaria Group in 2020. The private equity giant is now offloading Novaria Group at an opportune time. Aircraft production is forecast to grow in coming years as the sector continues recovering from the COVID-19 pandemic and as government spending on national security rises around the world.

Novaria Group provides parts for commercial and military aircraft, as well as drones and submersible vehicles. While privately held Arcline Investment has not commented publicly on the deal, Novaria Group CEO Bryan Perkins said in a media interview that the deal is a “success” for its partnership with KKR.

Profitability Issues

A lot of private equity firms, such as KKR, have struggled this year to sell companies they bought during a low-interest-rate environment at the outset of the pandemic. This has slowed returns for investors and hurt profitability.

KKR executives have sought to downplay concerns about profitability and deal-making during their recent quarterly earnings, which demonstrated rising performance income and strong financials. KKR says it improved revenues, productivity, and staff turnover during the time it owned Novaria Group.

Is KKR Stock a Buy?

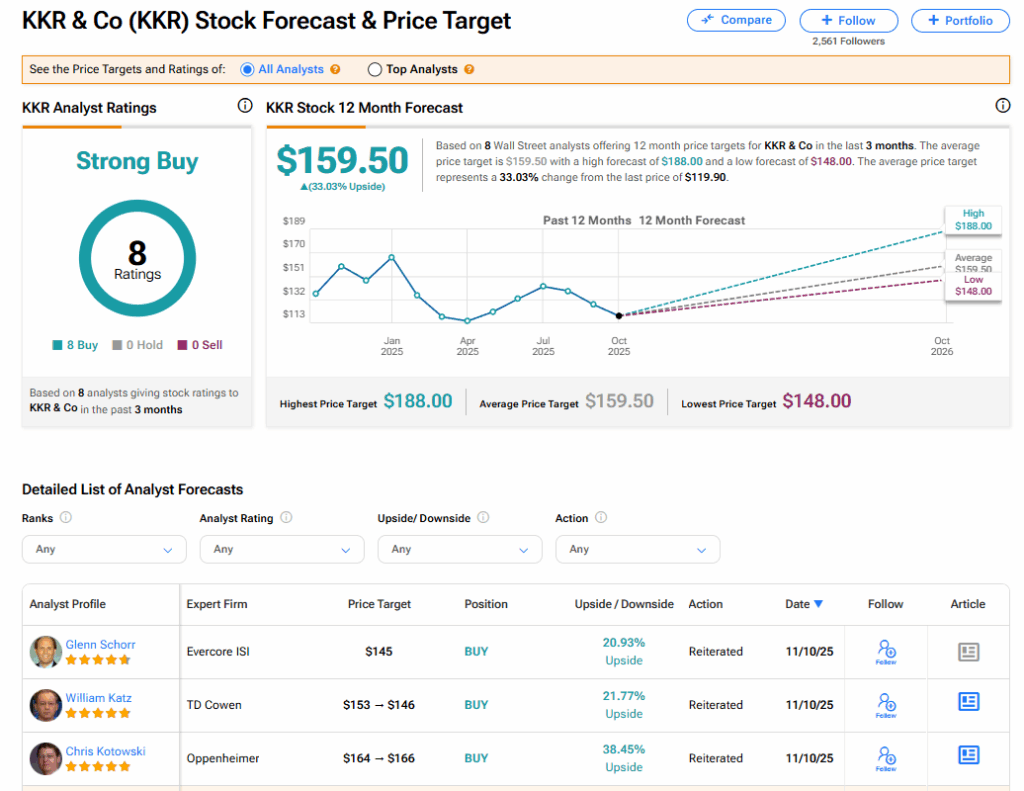

KKR stock has a consensus Strong Buy rating among eight Wall Street analysts. That rating is based on eight Buy recommendations issued in the last three months. The average KKR price target of $159.50 implies 33% upside from current levels.

Read more analyst ratings on KKR stock