KKR & Co. (KKR) said it will inject $1.5 billion in Reliance Industries’ Jio Platforms Ltd., its biggest investment in Asia.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As result of the transaction, which is still subject to regulatory approvals, KKR will own a 2.32% equity stake in Jio Platforms on a fully diluted basis. The deal values Jio Platforms at an equity value of about $65 billion.

Jio Platforms is an Indian telecommunications company that operates a national LTE network with coverage across all 22 telecom circles with more than 388 million subscribers.

“Few companies have the potential to transform a country’s digital ecosystem in the way that Jio Platforms is doing in India, and potentially worldwide,” said Henry Kravis, Co-Founder and Co-CEO of KKR. “Jio Platforms is a true homegrown next generation technology leader in India that is unmatched in its ability to deliver technology solutions and services to a country that is experiencing a digital revolution.”

This marks the 5th investment for Jio over the past month by large corporates, including Silverlake and Facebook (FB), taking the total to over $10 billion.

India has been a key strategic market for KKR with a history of investing in the country since 2006. The firm has in recent years invested over $30 billion (total enterprise value) in tech companies, and today its technology portfolio has more than 20 companies across the technology, media and telecom sectors.

Shares in KKR have been on a steep recovery path soaring 45% in the past two months and were trading at $26.84 as of Friday’s close.

Earlier this month, five-star analyst Chris Kotowski at Oppenheimer remained bullish on the stock with a Buy rating and a $34 price target, saying that the private equity firm is a “very compelling investment at 9.0x enterprise value (ex net cash & investments)”.

“We think there is significant upside to distributable earnings over time as there is ample room for the real asset and public market platforms to grow, balance sheet investment to be monetized and positive outlook regarding base management fee growth on funds associated with the next-generation flagships and other associated strategies,” Kotowski wrote in a note to investors.

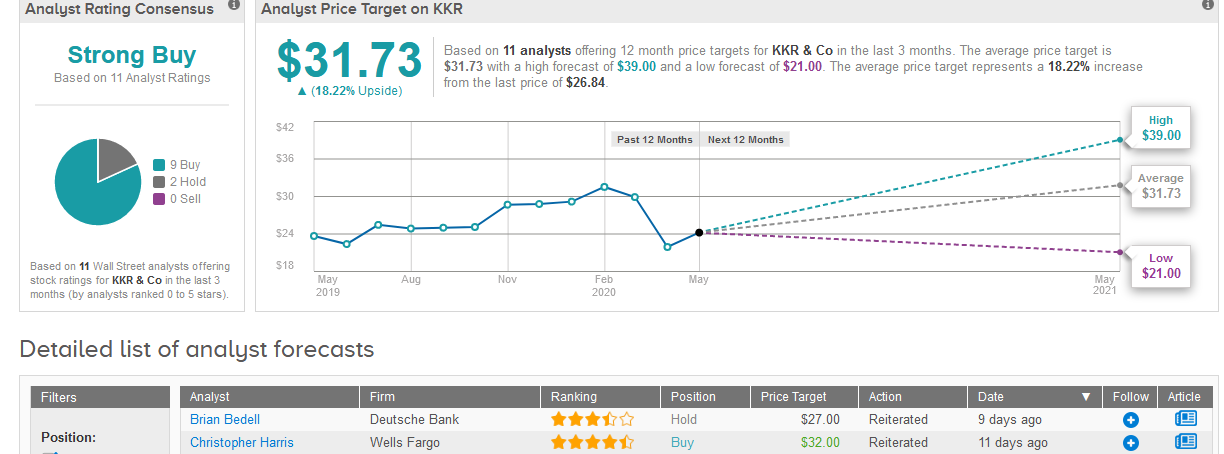

Turning now to the rest of the Street, TipRanks data shows that Kotowski’s bullish outlook is shared by another 8 analysts who have a Buy rating on the stock, while 2 are sidelined with a Hold rating adding up to a Strong Buy consensus. Despite the recent rally, the $31.73 average price target implies shares still have room to gain 18% in the coming 12 months. (See KKR stock analysis on TipRanks).

Related News:

Beleaguered Hertz Sinks 36% In After-Market On Bankruptcy Protection Filing

Facebook Invests An Eye-Watering $5.7B in India’s Jio Platforms

Nvidia Sinks Despite Stellar Earnings; Top Analyst Says Buy On Any Weakness