Financial services provider KKR & Co. (NYSE:KKR) has scored a high price target from TD Cowen analyst William Katz based on its promising long-term goals. On April 10, KKR held its annual investor day, revealing its long-term ambitions. Importantly, KKR is targeting at least AUM (Assets Under Management) of $1 trillion in the next five years and adjusted earnings per share (EPS) of $15 in ten years or less. Impressed by the goals, Katz lifted the price target for KKR stock to a Street-high of $144 (48% upside) and reiterated a Buy rating.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

KKR is a leading private equity and investment management company. As of December 31, 2023, KKR had $176 billion in private equity, $219 billion in credit, $59 billion in infrastructure, and $69 billion in real estate assets.

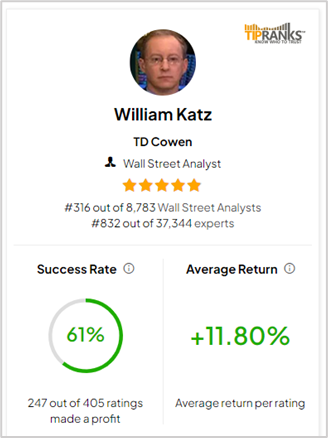

William Katz is a five-star analyst on TipRanks. Katz, who ranks 316 out of more than 8,700 analysts, boasts an 11.8% average return per rating, with a 61% success rate.

Katz’s Views on KKR’s Ambitions

Katz cited several levers for his optimistic view on KKR stock, including “multi-vectored organic growth” and platform scaling. Notably, the analyst is encouraged by the completion of the Global Atlantic (GA) acquisition on January 2, 2024. He added that the acquisition of the remaining stake in this retirement and life insurance company will enable KKR to accelerate its growth.

Also, Katz expects to benefit from continued strength in the capital markets and an increasing total addressable market (TAM) for the private equity players, which should benefit KKR. Furthermore, he sees solid growth in global wealth, Asia Pacific, Infrastructure, and credit/insurance segments. Katz also sees the possibility of KKR stock being included in the S&P 500 index (SPX). All these factors make KKR a compelling buying opportunity, as per the analyst.

Is KKR a Good Stock to Buy?

Following the investor update, several analysts reiterated their Buy views on the stock. On TipRanks, KKR stock has a Strong Buy consensus rating based on 12 Buys versus one Hold rating. The average KKR & Co price target of $108.62 implies 11.7% upside potential from current levels. In the past year, KKR shares have gained nearly 86%.

Ending Thoughts

KKR & Co. is poised for significant growth in the long term, backed by its ambitious plans. Katz is also optimistic about KKR’s stock trajectory, assigning a Street-high price target on the stock. Investors looking for “Strong Buy” stocks can consider KKR after thorough research.