KeyCorp (NYSE:KEY) had some trouble kicking off the new week, and that trouble continued well into Monday afternoon’s trading as well. Down significantly but off its lows by afternoon, KeyCorp lost ground following some disheartening statements from the bank’s Chief Financial Officer, Clark Khayat.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The problem—Khayat explained at the Morgan Stanley U.S. Financials, Payments and CRE Conference—was that net interest income was going to be lower than previously anticipated. A combination of “…funding mix and deposit cost pressures” was going to hit the net interest income figure particularly hard. Previously, KeyBank expected a loss of 4% to 5%, as established back during the first quarter earnings call. Now, KeyBank looks for a loss of 12%, which is between two to three times what was originally projected.

In what may be a move to try and ameliorate that potential plunge afoot, earlier reports from Market Screener noted that KeyCorp registered plans for “potential securities offerings” with the SEC. The filing includes “…the potential sale from time to time of various securities by the company or by some security holders.” This includes common and preferred shares, along with debt securities and other instruments. Trying to take on new sales possibilities may help reduce the impact of the net interest income losses ahead.

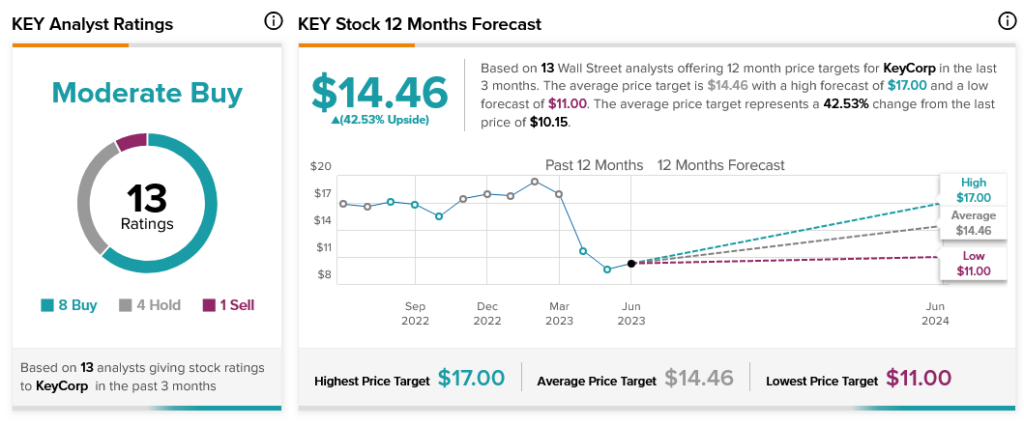

Even with this rough patch, analysts are still largely behind KeyBank. With eight Buy ratings, four Holds, and one Sell, KeyBank stock is considered a Moderate Buy. Further, it offers its investors 42.53% upside potential thanks to its average price target of $14.46 per share.