KeyCorp (NYSE:KEY) shares are trending lower today after the holding company for KeyBank posted lower-than-anticipated second-quarter numbers. Revenue declined 10.6% year-over-year to $1.6 billion, missing the cut by $30 million. EPS at $0.27 too fell short of expectations by $0.05.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

During the quarter, the common equity tier 1 ratio stood at 9.2% with expenses decreasing 9% sequentially. Additionally, while net charge-offs to average loans were at 17 basis points, deposits at the end of the quarter rose by $1 billion sequentially.

Further, average loans rose by $11.5 billion year-over-year to $120.7 billion. On the back of gains in the residential mortgage business, Consumer loans too rose by $2.5 billion in Q2. Nonperforming loans and assets at the end of June 2023 stood at $431 million and $462 million respectively.

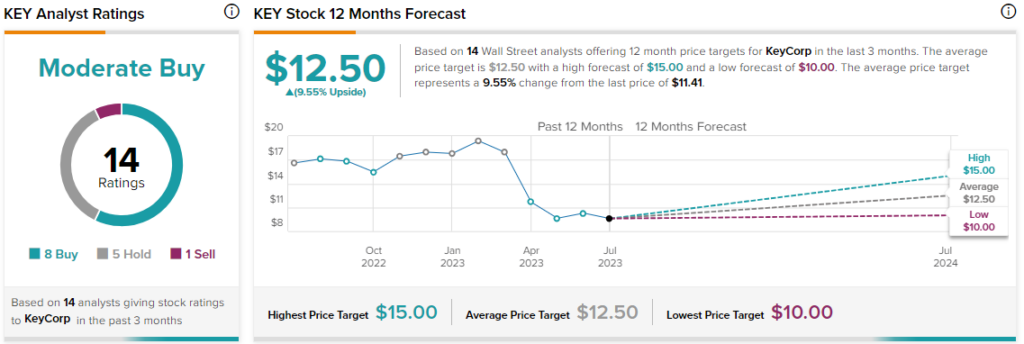

Overall, the Street has a $12.50 consensus price target on KeyCorp alongside a Moderate Buy consensus rating. Shares of the company have dropped nearly 37% over the past year.

Read full Disclosure