Kering SA (PPRUY) is in talks to sell its beauty business to L’Oréal SA (LRLCY) in a deal worth around $4 billion, according to a report by The Wall Street Journal. The sale could be announced next week if no other bidder enters or talks do not stall. The plan comes only weeks after Luca de Meo took over as Kering’s new chief executive.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Kering, which owns Gucci, Saint Laurent, and Balenciaga, started its beauty division in 2023 to make more perfumes and cosmetics in-house. It also bought Creed, a luxury cologne brand, that same year in an all-cash deal. However, the beauty arm has had a short run. Sales at Gucci have slowed in China, and Saint Laurent has faced a weaker market in the U.S. As a result, Kering’s broader business has felt pressure, and the company is looking for ways to cut debt, which stood near $11 billion as of June 30.

In the meantime, KER shares rose slightly yesterday, closing at €309.55.

L’Oréal’s Opportunity for Growth

For L’Oréal, based in Paris, the deal would add Creed to its extensive beauty line, which already includes L’Oréal Paris, Garnier, and Maybelline New York. It would also give the company a new chance to build products linked to Kering’s fashion labels, such as Bottega Veneta and Alexander McQueen. The move fits with L’Oréal’s long history of expanding its luxury brands through deals and brand partnerships.

If completed, the sale would be one of de Meo’s first major steps since joining Kering. Before this role, he led Renault (RNLSY) and worked on brand growth projects at Fiat and Seat. At Kering, his early focus appears to be on improving the company’s core fashion business rather than growing new units.

Overall, a sale to L’Oréal could help Kering simplify its operations while giving L’Oréal another push in the global beauty market. The talks also highlight how both companies are adjusting to slower luxury spending and looking for new ways to keep sales strong.

Is Kering a Good Stock to Buy?

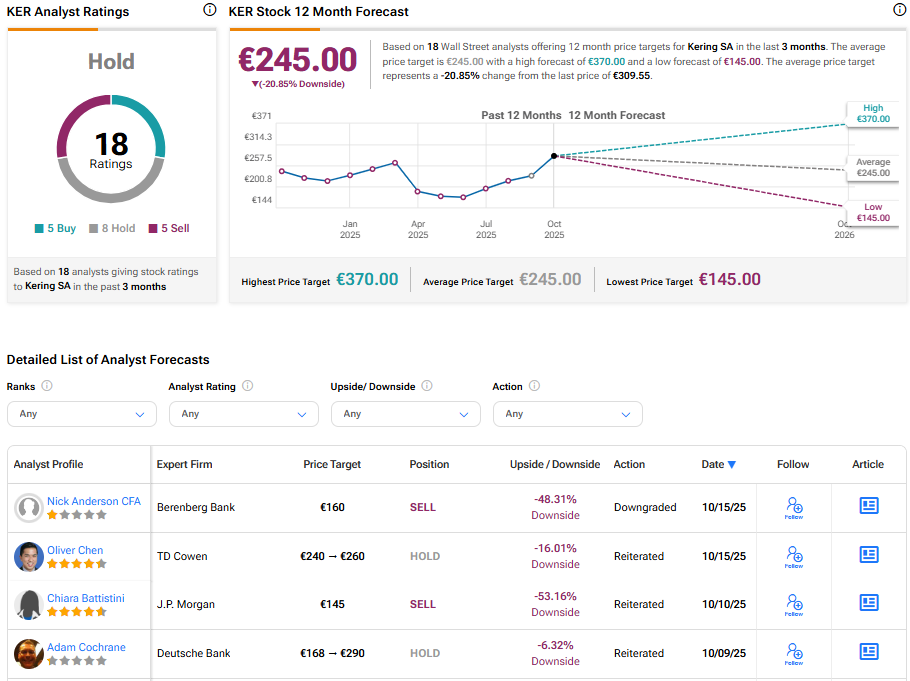

On the Street, Kering divides opinions, with a Hold consensus rating. The average KER stock price target stands at €245.00, implying a 20.85% downside from the current price.