Partnerships between different companies can open up opportunities for both and a new agreement between Palantir (NYSE:PLTR) and Oracle (NYSE:ORCL) appears mutually beneficial.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

Last Thursday, the two companies announced a collaboration aimed at providing secure cloud and AI solutions to both government and corporate clients. The arrangement involves transferring Palantir’s Foundry operations to Oracle Cloud Infrastructure. Additionally, Palantir’s Gotham and AI platforms will be available for deployment across Oracle’s distributed cloud infrastructure.

Analyst Michael Del Monte thinks this development brings about significant changes for both companies. For Oracle, the partnership opens doors to the coveted sovereign government sector. As for Palantir, it addresses two key challenges.

Firstly, it resolves an issue highlighted during their Q4 earnings call, where the company still faced difficulties in expanding their sales team to meet the increased demand for their product suite. Secondly, with Oracle’s “regionally scaled” and adaptable data centers, Palantir’s software can now be easily hosted at Oracle’s various locations whilst ensuring compliance with localized data privacy regulations.

It’s a win-win situation, says Del Monte. “Given Palantir’s deep roots across government entities, I believe that this strategic partnership will benefit both firms within their own respects,” he explained. “Further, I believe that this partnership will strongly benefit Palantir as this will hasten the deployment of their highly sought-after applications.”

Looking at the financial side, Del Monte thinks the big data specialist should be able to “overshoot” its Q1 guide for sales between $612-616 million and “far outpace” the consensus estimate ($617.44 million).

“I believe that the partnership with Oracle will facilitate strengthening of the sales process and will remove the risk factor of hosting services,” Del Monte further added.

To this end, Del Monte rates PLTR shares a Strong Buy, while his price target of $25.92 implies shares have upside of 13% from current levels. (To watch Del Monte’s track record, click here)

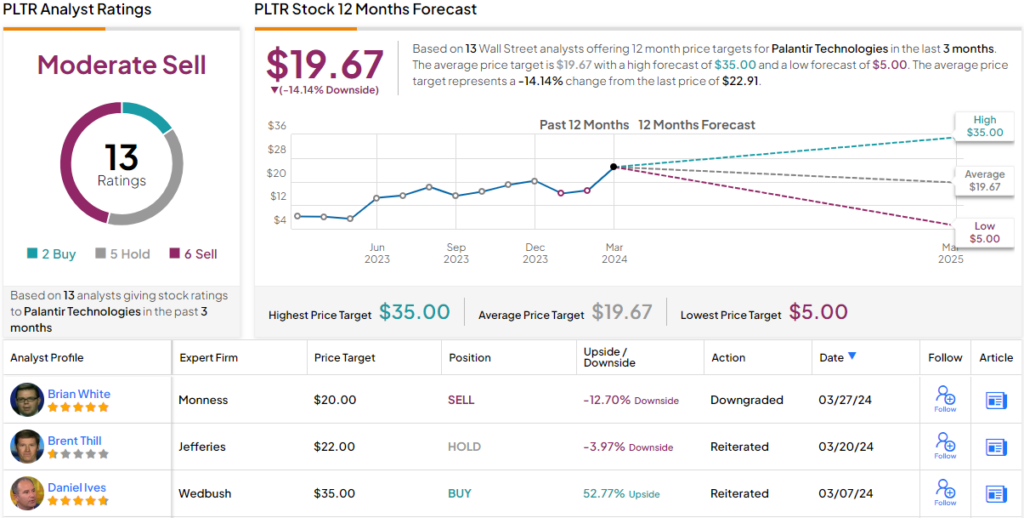

Del Monte’s take contrast with the general view on Wall Street. The analyst consensus rates the stock a Moderate Sell, based on a mix of 6 Sell recommendations, 5 Holds and 2 Buys. Going by the $19.67 average price target, a year from now, shares will be changing hands for a 14% discount. (See Palantir stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.