Shares of KBR jumped 12.6% after the engineering company announced 2025 financial targets at its virtual Investor Day, Future Forward.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

KBR (KBR) CEO Stuart Bradie said, “We are on a path to attractive revenue growth, margin expansion and cash generation, charting a course targeting to more than double our adjusted earnings per share by 2025 over 2021 levels.”

For the year 2025, the company expects revenue over $8 billion, reflecting a CAGR of 6%-9%. Adjusted EBITDA is forecasted to be more than $800 million with a CAGR of 8%-12%. Additionally, adjusted EPS is likely to be in the range of $4.00-$6.00, representing a CAGR of 15%-20%.

Furthermore, KBR has planned to deploy capital worth $3 billion through 2025 over priorities including organic reinvestment, dividends, share repurchases, and strategic acquisitions. (See KBR stock analysis on TipRanks)

Additionally, the company increased its quarterly cash dividend to $0.11 per share, up 10% from the prior payout of $0.10 per share. The new dividend will be paid on April 15 to shareholders of record as of April 5. The company’s annual dividend of $0.44 per share now reflects a dividend yield of 1.24%.

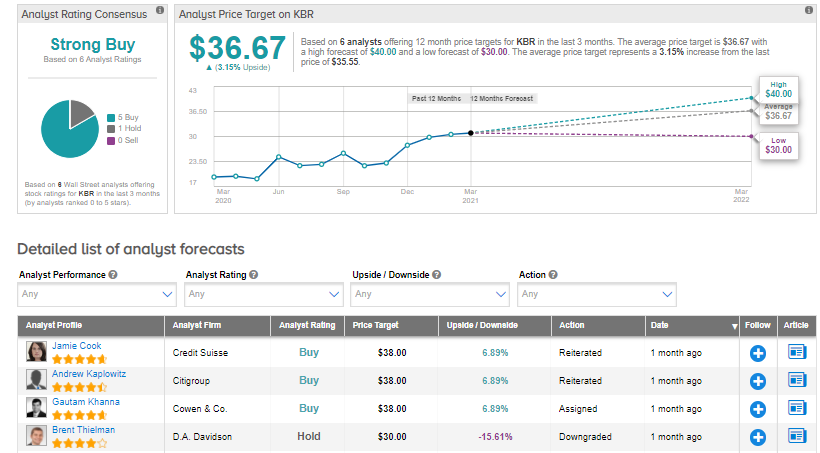

Following KBR’s investor day update, Cowen & Co. analyst Gautam Khanna maintained a Buy rating and a price target of $38 (6.9% upside potential).

Khanna said, “The investor day financial comments (avg 17.5% EPS CAGR) suggest upside to C22-23 Street EPS (4% and 9% respectively), & would position KBR as the fastest grower among gov’t service providers — well above that of MANT & J, which carry the sector’s richest valuations.”

The consensus rating among analysts is a Strong Buy based on 5 Buys versus 1 Hold. The average analyst price target stands at $36.67 and implies upside potential of 3.2% to current levels over the next 12 months. Shares have gained 67.2% over the past year.

Related News:

Ametek Inks Deal To Acquire Abaco Systems For $1.35B

IHS Markit’s Quarterly Results Top Analysts’ Expectations; Street Sees 26% Upside

Saratoga Investment Bumps Up Quarterly Dividend