KB Home’s (NYSE:KBH) first-quarter 2023 results exceeded analysts’ expectations despite a challenging housing market scenario. As a result, shares of the home builder gained about 3% on Wednesday’s extended trade.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

Earnings per share (EPS) of $1.45 easily surpassed the Street’s expectations of $1.13 but declined 1% year-over-year. Also, the company’s Q1 revenues fell about 1% to $1.38 billion. Nevertheless, the top line came in higher than the consensus estimate of $1.32 billion.

Coming to other key metrics, the company delivered 2,788 homes during the quarter, which reflects a year-over-year decline of 3%. Meanwhile, the average selling price rose 2% to $494,500. Furthermore, KB Home ended the quarter with a backlog of $3.31 billion, compared to $5.71 billion in the same quarter last year.

Alongside earnings, the company announced a share buyback program of up to $500 million, which replaced a prior authorization with a $75 million outstanding buyback capacity.

Outlook

Commenting on the near-term scenario, CEO Jeffrey Mezger said that the company is witnessing a rise in demand. This can be attributed to KB Home’s sales strategies and a stabilizing mortgage interest rate environment.

Moving on, the company expects the average selling price to be in the range of $480,000 and $490,000 for the full-year 2023. Also, KB Home anticipates generating housing revenues between $5.20 billion – $5.90 billion.

Regarding the second-quarter outlook, the company expects housing revenues in the range of $1.35 billion to $1.5 billion.

What Is the Forecast for KBH?

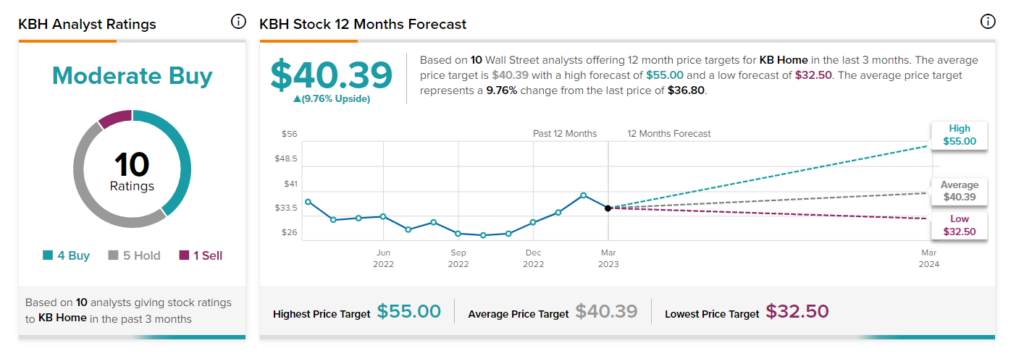

On TipRanks, the average KBH stock price target of $40.39 implies an upside potential of 9.8% from current levels. KB Home has a Moderate Buy consensus rating based on four Buys, five Holds, and one Sell rating. Year to date, KBH stock has gained 13.8%.