KB Home (NYSE:KBH) reported upbeat results for the fiscal second quarter as both earnings and revenues exceeded analysts’ expectations despite a challenging housing market scenario. Furthermore, the home builder raised guidance for Fiscal Year 2023, which also topped the consensus estimates.

KBH reported Q2 earnings per share of $1.94, which easily surpassed the Street’s expectations of $1.33 but declined 16.4% year-over-year. Meanwhile, the company’s revenues rose about 3% to $1.77 billion. Also, the top line came in higher than the consensus estimate of $1.39 billion.

In terms of other key metrics, the company delivered 3,666 homes during the quarter, which reflects a year-over-year growth of 6%. Further, the average selling price declined 3% to $479,500. Additionally, KB Home ended the quarter with a backlog of $3.46 billion, compared to $6.12 billion in the same quarter last year.

Fiscal Year 2023 Outlook

Commenting on the near-term scenario, CEO Jeffrey Mezger said that the company is benefiting from lower build times and direct construction costs. He added, “We believe our orders, starts and production are well-balanced and, with the sequential increase in our backlog at quarter-end, we are well-positioned to achieve our revenue target for 2023.”

For Fiscal 2023, KB Home now anticipates generating housing revenues between $5.80 billion – $6.20 billion, compared with previous guidance of $5.20 billion – $5.90 billion. The Street’s expectations are pegged at $5.67 billion. Further, the company expects the average selling price to be nearly $485,000.

Is KB Home Stock a Good Buy?

The stock has gained more than 61% so far in 2023. KBH’s strong global presence and strategic built-to-order business plan contribute to mitigating a number of challenges in the housing market to a certain extent.

Following the Q2 earnings release, Credit Suisse analyst Daniel Oppenheim reiterated a Hold rating on the stock but raised the price target to $51 from $42.

Overall, Wall Street analysts are cautiously optimistic about KBH stock. On TipRanks, KB Home has a Moderate Buy consensus rating based on four Buys and eight Holds. The average KBH stock price target of $48.65 implies 6.5% downside potential from current levels.

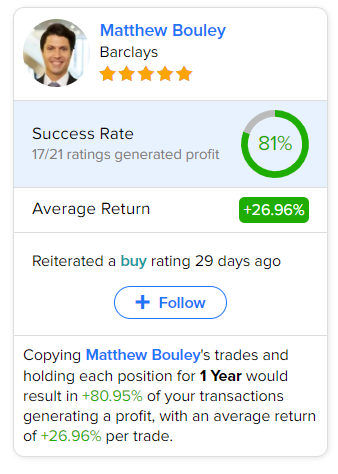

Remarkably, Barclays analyst Matthew Bouley is the most accurate and profitable analyst for KBH. Copying the analyst’s trades on this stock and holding each position for one year has resulted in 81% of transactions generating a profit, with an average return of 26.96% per trade.