Grubhub, owned by Just Eat Takeaway.com (DE:T5W), is laying off 15% of corporate jobs to become leaner, more efficient, and more cost-effective. Grubhub’s CEO, Howard Migdal, who took over the helms in March this year, broke the news to employees in a memo yesterday.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The layoffs would affect roughly 400 employees, and the company will pay severance expenses for at least 16 weeks. In the memo, Migdal said the step was necessary to remain competitive in the food delivery industry, where, post-pandemic, demand is declining as customers prefer to dine out more or pick up the food themselves. Recognizing this shift in customer behavior, Migdal highlighted the necessity of adapting to the changing landscape in order to stay relevant in the industry.

The Primary Catalyst Behind the Layoffs

Migdal acknowledged the bright future ahead for the online food delivery business and noted that Grubhub is ready to conquer the opportunities. At the same time, he said that these tough decisions are required to ensure the company offers the best services to its diners, and restaurant partners, and maintains its strong logistics network.

Grubhub is the third-largest food delivery platform in the U.S. after DoorDash (NYSE:DASH) and Uber Eats (NYSE:UBER). The company was taken over by Dutch player Just Eat Takeaway.com in 2021 in an all-stock deal for $7.3 billion. Surprisingly, within a year of the acquisition, Just Eat Takeaway.com announced its intention to explore a complete or partial sale of Grubhub. During Migdal’s leadership, he has engaged in extensive discussions with Grubhub employees, with the ultimate goal of optimizing operational efficiency.

What is the Price Target for Just Eat Takeaway Stock?

On June 5, Citi analyst Catherine O’Neill slashed the price target on the stock to €19.00 (50.1% upside potential) from €33.00 while maintaining a Buy rating.

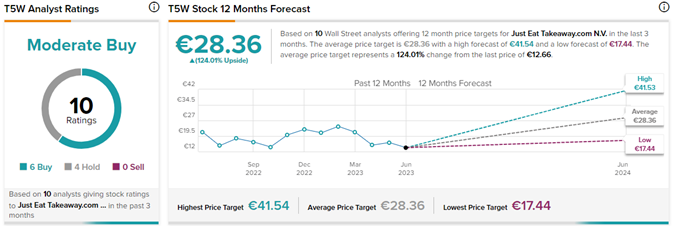

On TipRanks, the average Just Eat Takeaway.com price target of €28.36 implies an impressive 124% upside potential from current levels. Also, the stock has a Moderate Buy consensus rating based on six Buys versus four Hold ratings. Meanwhile, T5W stock has lost 36% year-to-date.