Juniper Networks, a leader in secure, artificial intelligence-driven networks, reported better-than-expected preliminary results for the fourth quarter. However, shares dipped 1.6% in Thursday’s extended trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Juniper’s (JNPR) revenues of $1.22 billion increased 1.2% and beat analysts’ expectations of $1.19 billion. The company’s CEO, Rami Rahim said, “We experienced better than expected Q4 demand and ended 2020 on a high note by delivering a second consecutive quarter of year-over-year revenue growth.”

The company’s adjusted earnings of $0.55 per share topped the Street’s estimates of $0.53 per share but declined 5.2% year-over-year due to lower operating margins.

As for 1Q, the company expects to generate revenues in the range of $1.005 billion to $1.105 billion, versus consensus estimates of $1.03 billion. It expects earnings in the range of $0.20 to $0.30 per share, compared to analysts’ expectations of $0.25 per share. (See Juniper stock analysis on TipRanks)

Following the results, Oppenheimer analyst George Iwanyc maintained a Buy rating and a price target of $28 (1.5% upside potential) on the stock. In a note to investors, the analyst said, “Juniper’s 4Q20 results came in above expectations as enterprise strength and resurgent routing growth offset flat cloud and weaker SP [service provider], switching, and security results. This allowed Juniper to post YoY revenue growth for the second straight quarter.”

He added, “From here, we see revenue growth improving into 2021, as the sales/product/engineering realignments position Juniper to gain share and as it doubles-down on use cases (AI [artificial intelligence]-driven enterprise, automated WAN [wide-area networking], and cloud-driven DC [data center]) with secular support.”

Overall, the Street has a cautiously optimistic outlook on the stock, with a Moderate Buy consensus rating based on 2 Buys and 3 Holds. The average analyst price target of $26.80 implies upside potential of about 2.6% to current levels. Shares have gained about 10.5% over the past year.

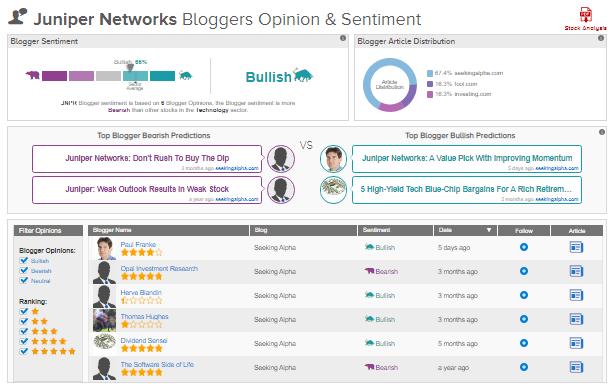

Furthermore, TipRanks data shows that financial bloggers have a bullish call on the stock.

Related News:

Apple Posts Record Quarter Driven By iPhone Sales; Shares Slip 3.3%

Microsoft’s Cloud Services Fuel 2Q Sales Beat; Shares Rise

F5 Networks Sinks 7.5% As 2Q Sales Outlook Disappoints