There seems to be no respite for American bank JPMorgan Chase (NYSE:JPM) in connection with the Jeffrey Epstein case. Per a WSJ report, an internal review conducted and concluded in 2019 showed that Epstein was closely connected with ex-employee Jes Staley during his tenure at the bank. The existence of numerous emails and personal meetings between the two individuals serves as evidence supporting the allegations made by several women regarding JPM’s involvement in Epstein’s wrongdoing. JPMorgan is also suing Staley in a separate case for misleading the bank and for being accused of sexual assault by an Epstein accuser in one of the bank’s lawsuits.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Further Findings of the Report

Within the 22-page report, references are made to instances where Epstein provided business advice to Staley and extended invitations for meetings with foreign government officials. Some correspondences show Epstein assisted Staley in personal matters, such as helping with his daughter’s admission to a Ph.D. program at Columbia University. Despite Epstein’s known misdemeanors, he remained a client at JPM both before and after 2008, when he was convicted of imploring a minor to engage in prostitution.

JPMorgan is currently fighting a lawsuit with the U.S. Virgin Islands that accuses JPM of ignoring Epstein’s immoral behavior because he bought in so much business and clients to the bank. The report could be made public in the Virgin Islands case and weaken the bank’s stance. Also, recently, the bank settled (paying $290 million) a lawsuit initiated by a woman using the pseudonym Jane Doe, who claimed JPMorgan knowingly benefited from and aided Epstein’s sex trafficking operation.

Will JPMorgan Stock Go Up?

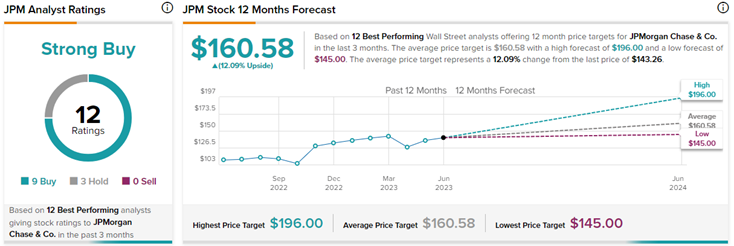

Recently, UBS analyst Daniele Brupbacher reiterated a Buy rating on JPM with a price target of $157 (9.6% upside potential). Overall, on TipRanks, the average JPMorgan Chase price target of $161.44 implies the stock has the potential to go up by 12.7% in the next 12 months.

Further, out of the 12 top analysts who recently rated JPM stock, nine have given it a Buy rating, and three have given the stock a Hold rating.