Financial giant JPMorgan Chase & Co. (NYSE:JPM) is taking algorithmic trading into the treasury market, according to The Trade.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

With this move, the company is now making algo orders available across markets and becomes the first dealer to go live on Bloomberg (for trading U.S. treasuries automatically).

Chi Nzelu, the company’s head of FICC eTrading noted, “This expansion of our U.S. Treasury rates algo franchise is an important milestone in our rates electronification journey…Algos help clients manage costs, efficiently access liquidity, and are an important utility in the toolkit given the current market environment.”

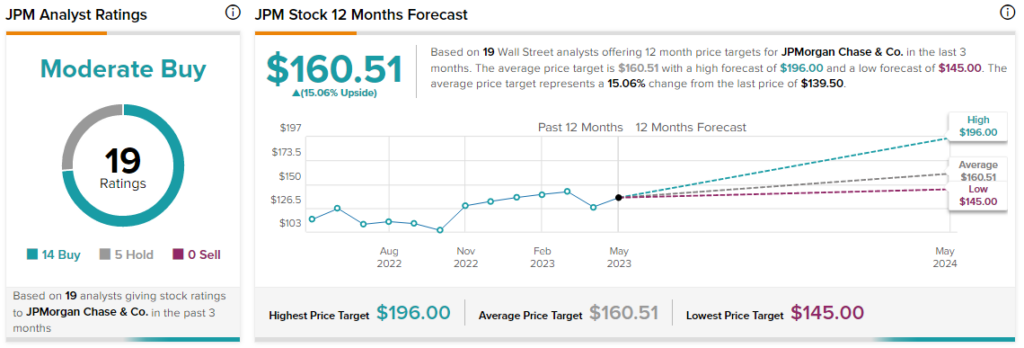

Overall, the Street has a $160.51 consensus price target on JPM alongside a Moderate Buy consensus rating. Shares of the company have gained about 16.2% over the past 52 weeks.

Read full Disclosure