JPMorgan Chase (NYSE:JPM) has filed an insurance claim to recoup some of the money it lost in the purchase of Frank, the student finance platform. After the acquisition, JPM realized the platform was not nearly as valuable as they thought. In an attempt to minimize its losses, JPM has filed a claim with the underwriter of its “Reps and Warranties” insurance policy.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Frank was founded in 2016 by a young entrepreneur, Charles Javice, to support college students applying for financial aid. Through Chase’s acquisition in 2021, the financial aid start-up company hoped to gain broader access to loans and the former saw an opportunity to work with 5 million students.

Post the acquisition, valued at $175 million, JPM noted that the delivery and open rates for its emails to Frank customers were significantly lower than expected. JPM claims that this was due to Javice having provided a false picture, presenting the number of customers as 4.25 million, while the number was actually only 300,000.

Javice’s Case?

Javice denies the bank’s charges of falsifying the account, but the U.S. authorities have charged her with fraud for faking user numbers to propel the sale. She was formally indicted in May for the same.

Alex Spiro, who represents Javice, sent a statement in January, saying, “They were provided all the data upfront for the purchase of Frank, and Charlie Javice highlighted the restrictions placed by student privacy laws during due diligence. When JPMC couldn’t work around those privacy laws after the purchase of Frank, JPMC began twisting the facts to cover their tracks.”

The founder stood to make $45 million from the sale and had also joined JPMorgan as a managing director. Her employment was later terminated for cause in November 2022.

What is “Reps and Warranties” Insurance?

The insurance payout is seen as providing some financial relief to JPMorgan, who usually takes out a “representations and warranties” insurance policy for coverage in such deals. The policy is a method to protect buyers from unforeseen losses or inaccuracies relating to a transaction post the deal’s closure.

Although there is no clarity about how much the bank will be able to recover, such policies cover between 10% and 20% of the purchase price, which in this case would be between $17.5 and $35 million.

Is JPM a Good Long-Term Investment?

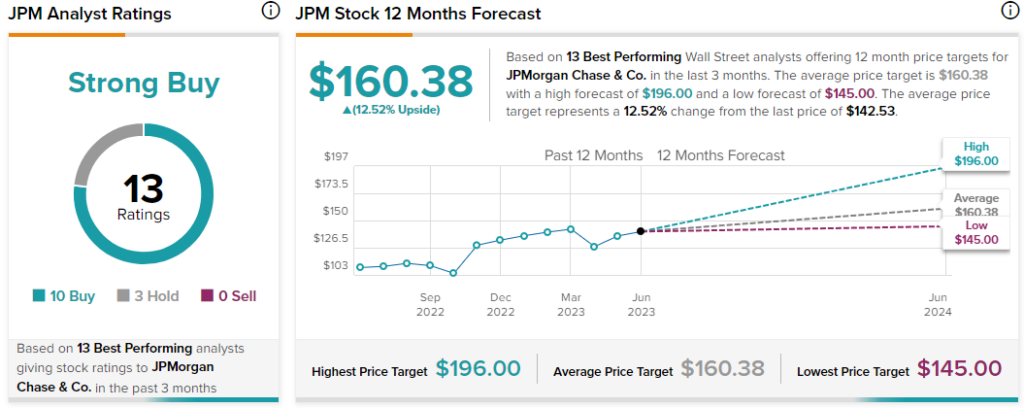

Of the 12 Top Wall Street analysts covering JPM, 10 have assigned a Buy while three rate it Hold, taking the average analyst consensus rating to a Strong Buy. Further, analysts’ 12-month average price target of $160.38 implies a 12.5% upside potential from current levels.

Morgan Stanley analyst Betsy Graseck reaffirmed her Buy rating on the Chase with a $160 price target implying a 12.3% upside potential from current levels.

In the past 3-months, the stock has surged 10%, taking the one-year gains to 27.2%.