While there have been some signs that banking giant JPMorgan Chase (NYSE:JPM) has been on the decline lately, it’s definitely not taking that lying down. In fact, it’s rolled out a new fund in a bid to draw investors in. The move was sufficient to send JPMorgan Chase up fractionally in the closing hours of Tuesday’s trading day.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The new fund, named JPMorgan Private Markets Fund, opens up access to private equity opportunities not normally available. Those who want in, meanwhile, will need a minimum $25,000 buy-in, and there are no capital calls to be concerned about. The new fund won’t be available everywhere, however; only certain private banks and “custodial platforms” have access right now. However, with 2024’s arrival, so too will come an expansion effort that sees the fund break into more sectors.

Is JPM a Buy, Sell, or Hold?

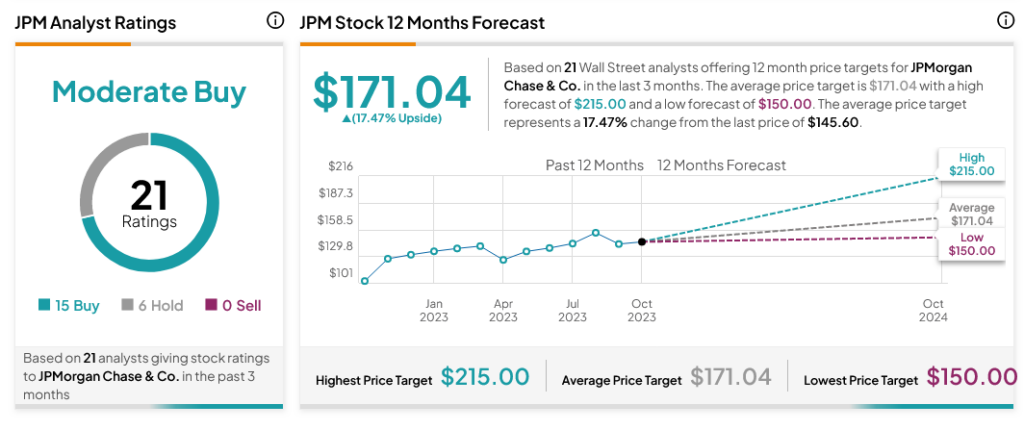

JPMorgan already enjoys a substantial amount of analyst support. With 15 Buy ratings and six Hold, JPMorgan stock is considered a Moderate Buy by analyst consensus. Further, the average JPM price target of $171.04 offers investors 17.47% upside potential.