Financial services giant JPMorgan Chase (NYSE:JPM) revamped its leadership team, focusing primarily on its investment banking and consumer units. The move has sparked interest in the succession plans for CEO Jamie Dimon.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to an SEC filing, Marianne Lake has been appointed as the sole CEO of the consumer division. This role was previously held jointly with Jennifer Piepszak. Concurrently, Piepszak has taken on the position of co-CEO for the recently merged commercial and investment bank, sharing the role with Troy Rohrbaugh, the former head of trading and securities services.

Analyst Stephen Biggar of Argus Research views Piepszak’s expanded responsibilities in commercial and investment banking as a strategic move in the broader context of succession planning, Reuters reported.

It remains to be seen who will succeed the current CEO, Jamie Dimon, considering he has a few more years left with the bank.

Is JPMorgan a Buy, Sell, or Hold?

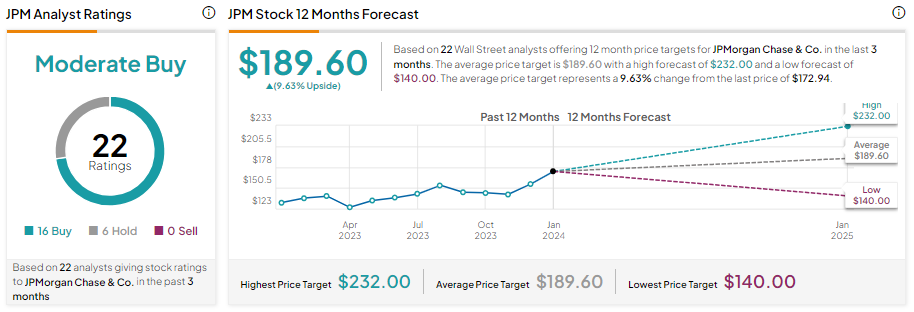

Wall Street is cautiously optimistic about JPMorgan Chase stock. JPM is likely to benefit from higher net interest income. However, an increase in operating expenses and credit costs may remain a drag.

JPM stock has gained about 27% in one year and sports a Moderate Buy consensus rating, reflecting 16 Buy and six Hold recommendations. Analysts’ average price target of $189.60 implies 9.63% upside potential from current levels.