America’s biggest bank by assets, JPMorgan Chase (NYSE:JPM), is trimming its workforce by 500 employees, mostly from the technology and operations fields. As per sources, the layoffs are spread across the bank’s Retail and Commercial Banking, Asset and Wealth Management, and Corporate and Investment Bank divisions. Meanwhile, the Jeffrey Epstein case continues to haunt the bank.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The bank undertakes regular check-ups of its workforce and trims positions if required. The news follows JPMorgan’s decision to fire 1,000 employees from the recently acquired First Republic Bank. On the other hand, the bank is now trying to fill over 13,000 available positions. JPM has begun making attempts to integrate the First Republic as seamlessly as possible.

On the Jeffrey Epstein front, JPMorgan’s CEO Jamie Dimon had a lengthened testimony on May 26, in which he denied having any connections with the former’s misdemeanors. Dimon repeatedly denied knowing Epstein or having any involvement in keeping his account.

JPMorgan and German lender Deutsche Bank (NYSE:DB) are alleged to have benefitted financially from Epstein’s business by continuing to serve his account despite knowing of his human trafficking activities. The lawsuits demand financial compensation from the banks for all the women who have been assaulted by the late sexual offender.

How High Will JPM Go?

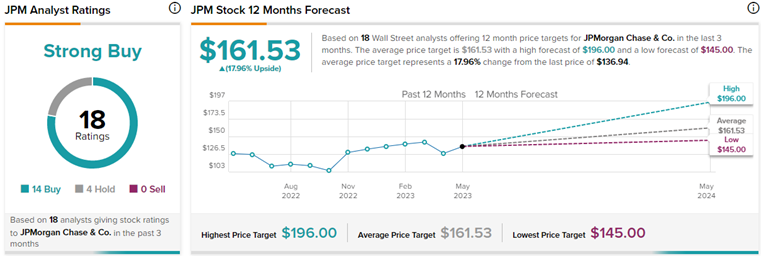

On TipRanks, the average JPMorgan Chase price target of $161.53 implies the stock has the potential to rise by 18% in the next 12 months. Also, JPMorgan commands a Strong Buy consensus rating based on 14 Buys and four Hold ratings. Meanwhile, JPM stock has gained 2.9% so far this year.