Analysts at U.S. bank JPMorgan Chase (JPM) expect retail investors to keep buying stocks into next year.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In a note to clients, JPMorgan said individual investors are likely to continue pouring money into equities through early 2026. The largest U.S. bank is basing its assumption on strong momentum among retail investors and steady inflows to exchange-traded funds (ETFs), a popular investment vehicle.

JPMorgan wrote that “the strong momentum in the retail impulse into equities seen over the previous two months is likely to be sustained into early 2026.” The bank highlights that stock-based ETFs attracted $160 billion of inflows in both September and October of this year, “the strongest pace of equity ETF buying since November and December 2024 after the U.S. election.”

Keep on Rolling

Retail investors have been largely credited with this year’s stock market rally, driving U.S. equities to all-time highs from the lows seen in April amid the initial tariff turmoil. Many institutional investors such as hedge funds and pensions have sat out the current rally, claiming market froth and high stock valuations.

It has therefore fallen to retail investors to keep the current rally going, a trend JPMorgan sees continuing at least through the first quarter of 2026. The bank notes that ETF flows and retail investor buying of stocks “tend to be more elevated around year-end, i.e. more elevated for December as well as for the first quarter of a year.”

Is the SPDR S&P 500 ETF Trust a Buy?

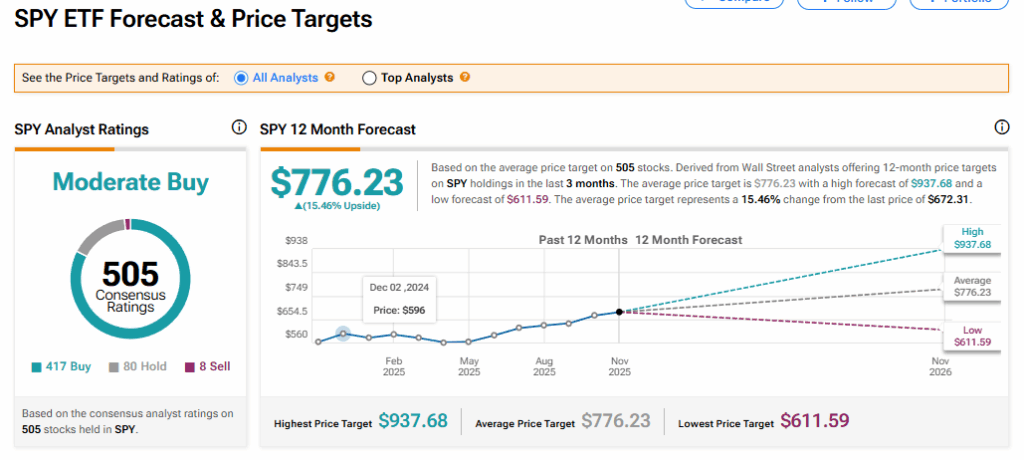

The SPDR S&P 500 ETF Trust (SPY) currently has a Moderate Buy rating among 505 Wall Street analysts. That rating is based on 417 Buy, 80 Hold, and eight Sell recommendations issued in the last three months. The average SPY price target of $776.23 implies 15.46% upside from current levels.