Shares of JPMorgan Chase (NYSE:JPM) are slightly down today as contagion fears from the collapse of Silicon Valley Bank (NASDAQ:SIVB) continue to spread across the industry. Nevertheless, analyst Mike Mayo of Wells Fargo (NYSE:WFC) upgraded his rating on JPM from Hold to Buy while assigning a price target of $155.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Mayo believes that the bank will benefit from the struggles seen by its peers, stating that “Recent industry developments should further its ability to gather core funding and act as a source of strength.” As a result, he upped his EPS forecast for 2023, 2024, and 2025 to $12.90, $13.30, and $14.66, respectively.

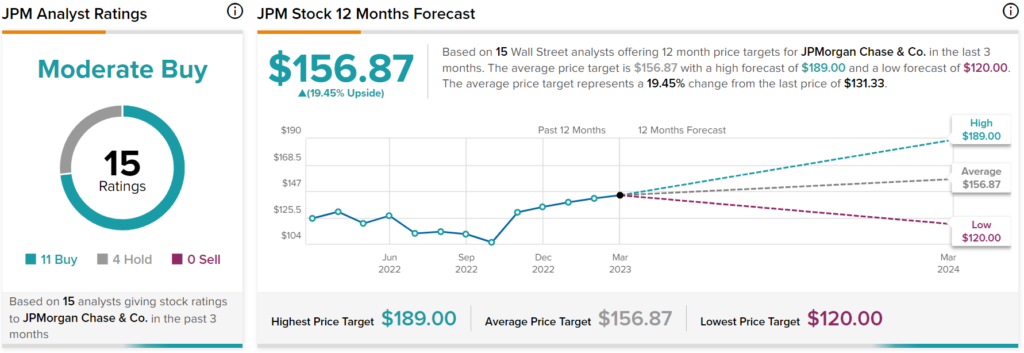

Overall, Wall Street analysts have a consensus price target of $156.87 on JPM stock, implying over 19% upside potential, as indicated by the graphic above.