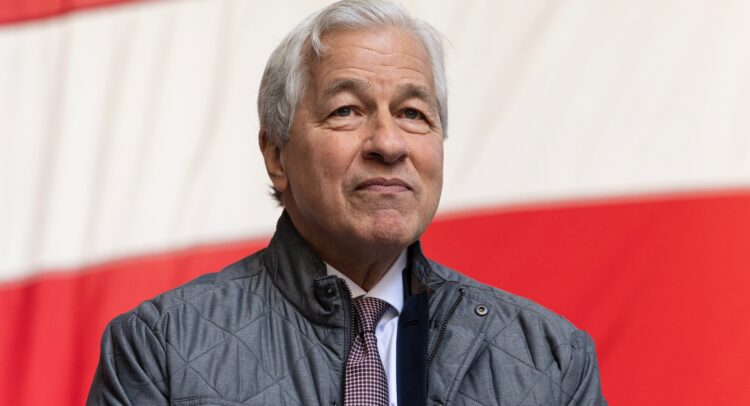

Jamie Dimon, CEO of JPMorgan Chase & Co. (NYSE: JPM), the largest bank in the U.S., worries that achieving a soft landing amid geopolitical problems is a long shot. This less optimistic economic outlook contrasts with the views of many financial experts. In a recent interview with The Wall Street Journal, Dimon pointed to geopolitical tensions, particularly the war in Ukraine, as his biggest concern for the global economy.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

A soft landing is where economic growth slows without causing a recession or major harm. According to Dimon this looks increasingly difficult in today’s geopolitical climate.

Soft Landing or Recession?

The consensus on Wall Street is largely optimistic about a ‘soft landing’ for the U.S. economy, with a perceived 70% chance of avoiding a recession. However, Dimon believes the odds are closer to 50/50. He expressed concerns that inflation might linger for longer than anticipated due to various difficult factors.

Dimon worries about inflationary factors, which include spending on the green energy transition, high military spending, huge government deficits, and high geopolitical instability. These challenges lead the top bank CEO to lean more towards anticipating a recession than his peers.

Despite these negative forces, Dimon acknowledges the positive aspects of the current economic situation, such as low unemployment, and expresses confidence in the Federal Reserve’s ability to navigate the challenges.

Dimon Draws Parallels to 1970s Stagflation

The bank CEO expressed his concern about the potential return of stagflation, a period of stagnant economic growth coupled with persistent inflation. He noted parallels between the current economic climate and the 1970s, when a similar situation unfolded.

FOMC Took Too Long to Raise Rates

In the interview, Dimon acknowledges Jerome Powell’s leadership as Federal Reserve Chair but then suggests the Fed may have been slow to raise interest rates initially. It’s now clear that inflation was not transitory. However, he believes the central bank is currently taking the right approach by adopting a wait-and-see, data-driven stance.

Key Takeaway

Jamie Dimon’s interview highlights a more cautious perspective on the U.S. and world economy compared to others. Geopolitical tensions and lingering inflationary pressures raise concerns about the possibility of a soft landing. However, he does see positives in the high employment aspect of the current economic situation.