Big banks JPMorgan Chase & Co. (NYSE:JPM), Bank of America (NYSE:BAC), Wells Fargo (NYSE:WFC), and Citigroup (NYSE:C) are scheduled to announce their results for the fourth quarter of 2022 on January 13. Ahead of the earnings of the major banks, Wall Street’s sentiment is cautious due to macro challenges and fears of a looming recession.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Cautious Sentiment Ahead of Q4 Results

Continued rate hikes to tame inflation helped banks boost their net interest income (NII) in recent quarters. However, Wedbush analyst David J. Chiaverini feels that further rate hikes could slow economic growth and trigger a recession, which would negatively impact loan growth and credit costs.

Moreover, Chiaverini expects banks to be hit by continued deposit outflows, a trend that started in Q2 2022 for several banks. Chiaverini expects Q4 earnings to be “decent” for most banks due to higher NII. Nonetheless, he cautions that the positive momentum in NII “may be starting to fade.”

Likewise, Deutsche Bank analyst Matt O’Connor maintained a cautious view on banks ahead of the Q4 results due to ongoing macro challenges and “likely weakening bank fundamentals.” O’Connor expects NII and loan growth to remain strong in Q4 for BAC, JPM, WFC and Citigroup. However, he anticipates investment banking fees to be sluggish.

A collapse in IPO activity and debt and equity issuance has impacted investment banking revenue in recent quarters. Furthermore, banks are facing pressure in their mortgage lending business due to higher interest rates. On Tuesday, Wells Fargo announced its plans to scale down its mortgage business, reflecting the impact of the ongoing challenges.

O’Connor stated that his Q4 earnings per share (EPS) estimates for the bank sector are 6% below the Street’s consensus expectations as he projects higher loan loss reserves and lower NII for some banks. The analyst noted that there have been increasing concerns about net interest margins approaching peak levels in the first half of this year and then declining in the second half.

It’s worth noting that as per TipRanks, Matt O’Connor is ranked 469 out of 8,244 Wall Street analysts. He has a success rate of 64%, with an average return per transaction of 11.4%.

JPMorgan Chase (NYSE:JPM)

Heading into Q4 2022 results, O’Connor downgraded JPMorgan to a Hold from Buy and lowered the price target to $145 from $155. JPMorgan’s higher exposure to credit cards and capital markets compared to regional banks triggered the rating downgrade.

O’Connor expects JPM’s Q4 investment banking fees to fall 56% year-over-year and projects an 11% rise in trading revenue. Overall, the Street’s consensus Q4 EPS estimate of $3.08 indicates a 7.5% year-over-year decline.

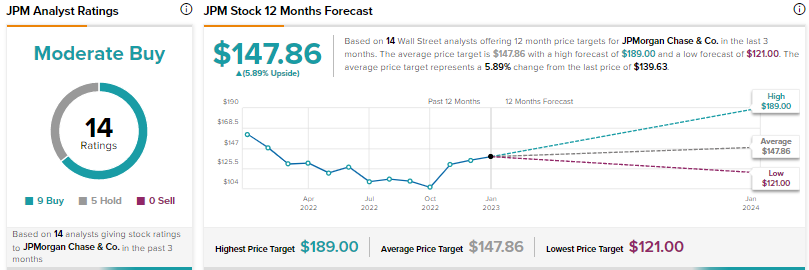

Is JPM a Buy Now?

Wall Street’s Moderate Buy consensus rating for JP Morgan Chase stock is based on nine Buys and five Holds. The average JPM stock price target of $147.86 implies nearly 6% upside potential from current levels. Shares have declined 14.4% over the past year.

Bank of America (NYSE:BAC)

O’Connor also downgraded Bank of America stock to a Hold from Buy, citing the same reasons as in the case of JPM. The analyst lowered his price target for BAC stock to $36 from $45. Wall Street expects BAC’s Q4 EPS to fall 6.1% to $0.77. Persistent weakness in investment banking fees and higher expenses are expected to weigh on the Q4 bottom line.

What is the Target Price for BAC Stock?

Bank of America stock earns a Moderate Buy consensus rating based on seven Buys and five Holds. The average BAC price target of $40.63 suggests 18.2% upside potential. BAC stock has plunged 28% over the past 52 weeks.

Wells Fargo (NYSE:WFC)

O’Connor lowered his price target for Wells Fargo stock to $50 from $60 but maintained a Buy rating. The analyst noted that during Q4 2022, WFC entered into a $3.7 billion settlement with the Consumer Financial Protection Bureau (CFPB) to resolve multiple issues over customer abuses related to auto lending, consumer deposits, and mortgage lending.

WFC expects to incur $3.5 billion (pre-tax) in operating losses in Q4 2022 due to incremental costs related to the CFPB civil penalty and customer remediation efforts, as well as other legal matters. Analysts expect WFC’s Q4 EPS to decline by more than 56% to $0.60.

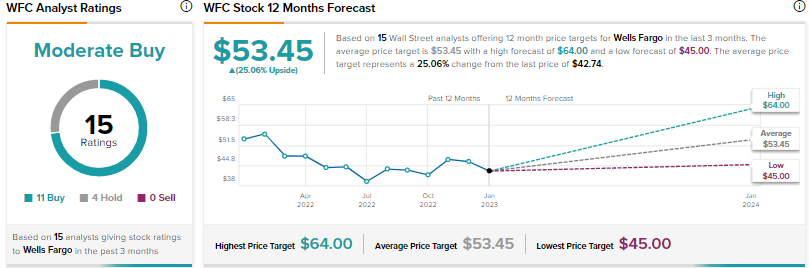

Is Wells Fargo Stock a Buy or Sell?

The Street’s Moderate Buy consensus rating for Wells Fargo stock is backed by 11 Buys and four Holds. At $53.45, the average WFC stock price prediction implies 25.1% upside potential. Wells Fargo stock has fallen 22.5% over the past year.

Citigroup (NYSE:C)

Wall Street projects Citigroup’s Q4 EPS to come in at $1.16, which indicates 20.5% year-over-year decline. O’Connor highlighted that management’s intra-quarter outlook indicates a 10% rise in trading revenue and a 60% decline in investment banking fees. The analyst cut his price target for Citigroup stock to $46 from $52 and reiterated a Hold rating.

During Q4 2022, Citigroup closed its consumer businesses in Bahrain, Malaysia, and Thailand. It expects these exits to fetch $1 billion of regulatory capital benefits.

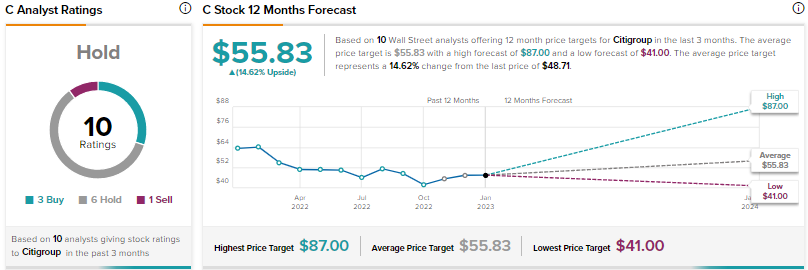

What is the Price Target of Citigroup?

Wall Street is sidelined on Citigroup stock, with a Hold consensus rating based on three Buys, six Holds, and one Sell. The average Citigroup price target of $55.83 implies 14.6% upside potential. Shares have retreated nearly 25% over the past 52 weeks.

Conclusion

Market sentiment is cautious for banks ahead of the upcoming results due to continued macro pressures weighing on investment banking and mortgage lending. Moreover, there are concerns that the positive momentum in NII might fade as the year progresses due to deposit outflows and bad debt provisions might increase due to a potential recession.