Arm Holdings (NASDAQ:ARM), the semiconductor and software design company, continued to slide in trading as investors were disappointed by the company’s Fiscal Q2 results and guidance. However, Wall Street analysts remained upbeat about the company’s outlook, calling it “better than expected.”

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Top-rated JP Morgan analyst Harlan Sur reiterated his Buy rating on the stock and a price target of $70, implying an upside potential of 28.7% at current levels. The analyst was optimistic about Arm’s “record” bookings of $1.1 billion and its orders backlog that went up by 40% sequentially.

The company has also benefitted from its deal with Apple (AAPL), two new customers, and two license renewals granting customers access to Arm’s technology. As a part of Arm’s agreement with Apple, the tech giant uses Arm’s chip technology to design custom chips for its iPads and iPhones.

Analyst Sur commented, “We believe that overall chip design activity for datacenter [and] accelerated compute has been accelerating and that AI is penetrating across multiple end markets, which is benefitting Arm.” The analyst also believes that the company could see higher penetration when it comes to the personal and edge computing end markets.

What is the Target Price for ARM Stock?

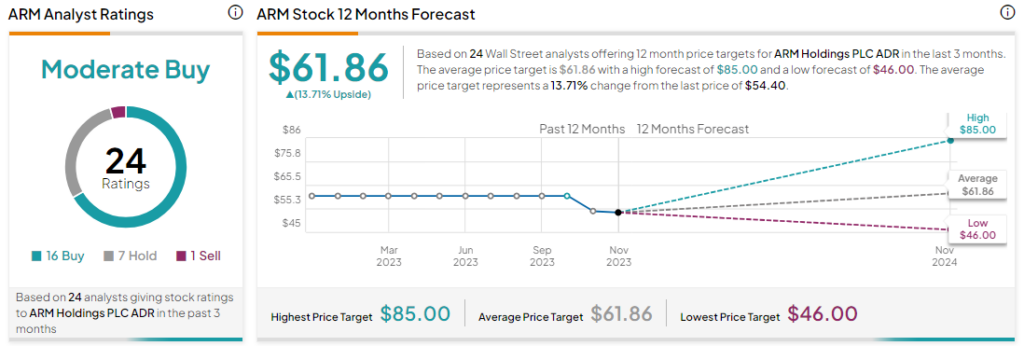

Analysts are cautiously optimistic about ARM stock with a Moderate Buy consensus rating based on 16 Buys, seven Holds, and one Sell. The average ARM price target of $61.86 implies an upside potential of 22.9% at current levels.