While Johnson & Johnson (NYSE:JNJ) is easily one of the leaders in health care today, there’s always some room for improvement, branching off into new markets and augmenting its position in old ones. To that end, it recently moved to acquire Ambrx Biopharma (NASDAQ:AMAM). Investors, however, weren’t excited and sent Johnson & Johnson down fractionally in Monday morning’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Johnson & Johnson’s acquisition gives it a new set of tools to use in fighting cancer. With Ambrx on its side, Johnson & Johnson can now offer a new set of “antibody-drug conjugates,” or ADCs. In fact, one of Ambrx’s flagship releases, known as ARX517, is specifically targeted toward prostate cancer, especially metastatic prostate cancer that’s resistant to castration attempts.

It’s still in fairly early testing, but now, Johnson & Johnson scientists will get in on the action and attempt to push the product out more rapidly. The deal was ultimately valued at around $2 billion, with Johnson & Johnson offering $28 per share for Ambrx.

Johnson & Johnson Will Need New Cash Cows

This is actually better news than you might think for Johnson & Johnson, as it comes right on the heels of another bit of news that means a big expense for Johnson & Johnson. Specifically, Johnson & Johnson has agreed to shell out around $700 million—about a third of what it paid for Ambrx—to resolve a “probe” into how it marketed baby powder. The payout is apparently designed to protect Johnson & Johnson from future liability about baby powder and its connection to cancer. However, just how far that protection extends is ultimately unclear. Still, it’s clear that Johnson & Johnson will need some new cash cows to effectively address the piles of lawsuits and probes the baby powder matter is still bringing about.

Is Johnson & Johnson a Good Stock to Buy Now?

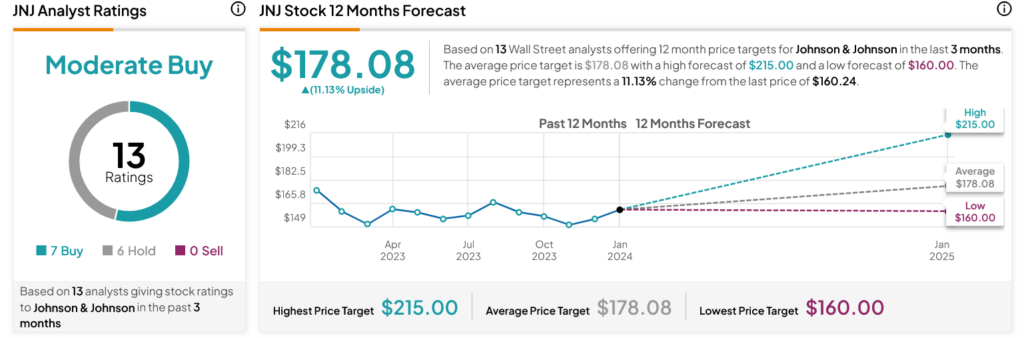

Turning to Wall Street, analysts have a Moderate Buy consensus rating on JNJ stock based on seven Buys and six Holds assigned in the past three months, as indicated by the graphic below. After a 5.94% loss in its share price over the past year, the average JNJ price target of $178.08 per share implies 11.13% upside potential.