Pharmaceutical giant Johnson & Johnson (NYSE:JNJ) delivered stronger-than-expected third-quarter earnings. However, the company’s MedTech division is battling an unfavorable product mix and commodity inflation, which is hurting its margins. Thus, to boost its margins in the MedTech segment, JNJ announced a two-year restructuring plan.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The program will primarily focus on simplifying the operations of the orthopedic business (a part of the MedTech division), which could witness a modest revenue decline of approximately $250 million over the next two years. Johnson & Johnson will exit specific markets and product lines across the orthopedic business as part of the strategy. The company expects to complete the restructuring plan by 2025 and foresees incurring costs of $700 million and $800 million.

While JNJ is focusing on enhancing its margins, it also raised its full-year sales and earnings outlook, which is encouraging. However, these positive developments failed to lift Johnson & Johnson’s stock higher as the company anticipates challenges ahead for its popular obesity drugs.

With this backdrop, let’s look at the Street’s recommendations for JNJ stock.

Is Johnson & Johnson Stock Expected to Go Up?

Johnson & Johnson is poised to deliver strong financials in 2024 and 2025, led by new product introductions in both the Innovative Medicine Unit and the MedTech segment. Following the better-than-expected Q3 earnings, TD Cowen analyst Josh Jennings reiterated his Buy on October 17.

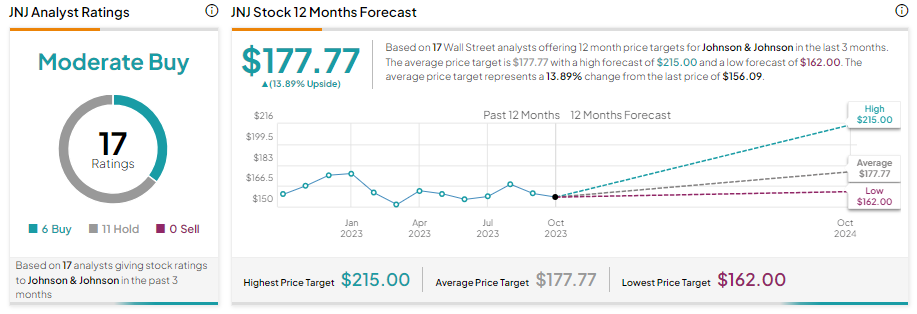

Overall, with six Buys and 11 Holds, JNJ stock has a Moderate Buy consensus rating on TipRanks. Meanwhile, analysts’ average price target of $177.77 implies 13.89% upside potential from current levels.