Healthcare giant Johnson & Johnson (NYSE:JNJ) is scheduled to announce its results for the fourth quarter of 2022 on January 24. While the company’s key businesses are generally resilient during economic downturns, they are not completely immune to macro pressures. Currency headwinds and higher costs are expected to weigh on JNJ’s Q4 2022 results.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Q4 2022 Expectations and 2023 Outlook

JNJ’s sales grew 1.9% to $23.8 billion in Q3 2022, fueled by the performance of the Pharmaceutical and MedTech divisions, which helped offset the lower sales from the Consumer Health division. Adjusted earnings per share (EPS) declined 1.9% to $2.55. Nonetheless, both sales and EPS came ahead of expectations.

Analysts expect Q4 revenue to decline 3.6% year-over-year to $23.9 billion, while adjusted EPS is projected to rise 5% to $2.24. The company is anticipated to benefit from higher sales of Darzalex, Tremfya, and Erleada drugs.

JNJ completed the acquisition of Abiomed in late 2022. Consequently, Abiomed’s performance might not have a material impact on Q4 results. Meanwhile, forex headwinds and competition from generics and biosimilars for some of JNJ’s key drugs are expected to weigh on the Q4 results.

Analysts and investors will pay attention to JNJ’s 2023 outlook, especially as the company is gearing up to spin off its Consumer Healthcare unit into a separate company called Kenvue. The spin-off is expected to be completed by mid to late 2023. Analysts currently project 2023 adjusted EPS to rise 2.7% to $10.33.

Is JNJ a Good Stock to Buy?

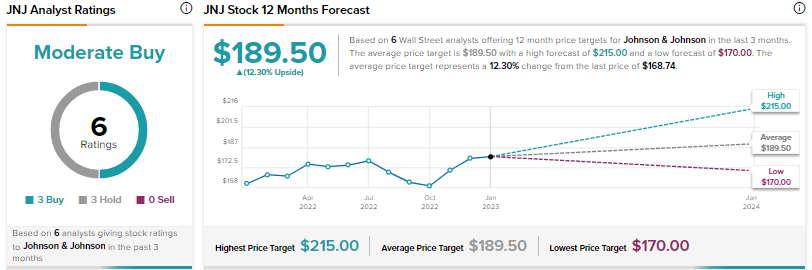

Wall Street is cautiously optimistic about Johnson & Johnson stock, with a Moderate Buy consensus rating based on three Buys and three Holds. The average price target of $189.50 implies 12.3% upside potential. Shares have advanced 6.3% over the past year.

Additionally, JNJ is a dividend king and has raised its dividends for 60 consecutive years. Its dividend yield stands at 2.6%.

Final Thoughts

JNJ’s Q4 results are expected to reflect the resilience of the healthcare behemoth’s revenue streams amid the ongoing macroeconomic challenges. Nonetheless, results could be under pressure due to inflation and adverse currency movements. Looking ahead, the company is set to become a more focused organization following the spin-off of its Consumer Health business. It sees abundant growth opportunities for its Pharmaceutical and MedTech divisions.

Join our Webinar to learn how TipRanks promotes Wall Street transparency