For Johnson & Johnson (NYSE:JNJ), 2023 will mark a turning point as the company completes the separation of its Consumer Health business, Kenvue. Reportedly, JNJ eyes a $40 billion valuation for Kenvue.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

During the Q4 2022 conference call, JNJ’s CEO Joaquin Duato said that the company has started to operate its consumer business “as a company within a company” and filed for an IPO. Progressing on the separation and IPO listing, the company will start a roadshow to pitch for the shares of Kenvue to raise funds.

According to a Wall Street Journal report, Kenvue could start meeting investors as early as Monday to raise $3.5 billion or more at a valuation of approximately $40 billion. Upon listing, Kenvue would trade under the ticker KVUE.

JNJ’s Consumer Health business delivered revenues of $14.95 billion in 2022. The segment owns the famous brand Band-Aid and makes well-known over-the-counter medicines and skin and baby care products.

Whether Kenvue’s IPO becomes a success or fails to raise the target amount due to economic uncertainty remains a wait-and-watch story. Meanwhile, JNJ continues to crush analysts’ earnings estimates. Let’s look at what Wall Street analysts recommend for JNJ stock.

What’s the Prediction for JNJ Stock?

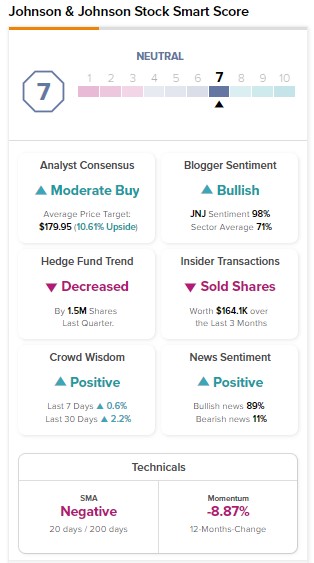

The ongoing weakness in LOE (Loss of Exclusivity) products could continue negatively impacting JNJ’s short-term financials. JNJ stock has received five Buy and 12 Hold recommendations for a Moderate Buy consensus rating on TipRanks. Analysts’ average price target of $179.95 implies 10.61% upside potential.

While analysts are cautiously optimistic, hedge funds and insiders sold JNJ stock in the past quarter. Meanwhile, the stock sports a Neutral Smart Score of seven.