JOANN (NASDAQ:JOAN) shares are ticking higher today after the fabric and sewing product retailer announced its second-quarter numbers. During the quarter, revenue declined 2.1% year-over-year, amounting to $453.8 million, but it still came in ahead of expectations by ~$16.4 million. On the other hand, the net loss per share of $1.76 was wider than estimates by $0.51.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The quarter was characterized by a sequential improvement in comparable sales and a 470-basis point expansion in gross margin, reaching 51.1% for the company. JOANN is focusing on its strategy to expand leadership in its core textile and craft-related categories.

Furthermore, it expects to realize annual cost reductions to the tune of $200 million from its operational efficiency initiatives. Looking ahead to the full fiscal year 2024, JOANN expects net sales to decline in the range of 1% to 3%. Adjusted EBITDA for the year is seen landing between $85 million and $95 million.

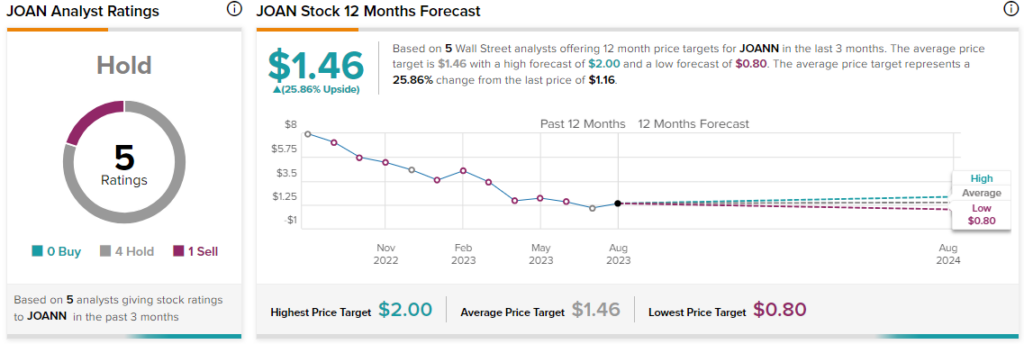

Overall, the Street has a consensus price target of $1.46 on JOANN, alongside a Hold consensus rating. Shares of the company have tanked nearly 85% over the past year.

Read full Disclosure