Johnson & Johnson (JNJ) reported third-quarter sales and earnings that beat expectations, leading the company to raise its full-year revenue guidance. The healthcare giant also announced plans to spin off its orthopedics business within 18 to 24 months, separating it from the rest of the company as part of its growth and strategic restructuring plans. Following the announcement, JNJ stock fell over 1% in pre-market hours.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

J&J Reports Strong Q3

For the third quarter, Johnson & Johnson sales grew 6.8% year-over-year to $24.0 billion, beating the $23.7 billion analyst estimate. Meanwhile, adjusted earnings per share (EPS) came in at $2.80, slightly above the $2.76 expected.

Looking ahead, the company raised its 2025 sales guidance midpoint by $300 million to $93.7 billion and reaffirmed full-year adjusted EPS guidance of $10.85, despite higher tax costs.

J&J Announces Orthopedics Spin-Off as Separate Company

Alongside its earnings report, J&J said it plans to separate its slower-growing orthopedics business from the rest of the company within 18 to 24 months. This move will give its innovative drug and medical device operations more room to grow, especially as U.S. regulators push pharmaceutical companies to lower prices.

The company said it plans to focus on high-growth, high-margin areas as part of the separation, including oncology, immunology, neuroscience, surgery, vision care, and cardiovascular.

J&J’s orthopedics unit, which makes hip, knee, and shoulder implants, surgical instruments, and other products, generated about $9.2 billion last year, which was around 10% of the company’s total revenue. The planned spin-off comes after J&J’s 2023 two-year orthopedics restructuring, which saw the company exit select markets and drop some products.

J&J Chief Financial Officer Joe Wolk said the company is considering multiple options for the separation, with a primary focus on a tax-free spin-off, but remains open to other approaches.

Is JNJ a Good Stock to Buy?

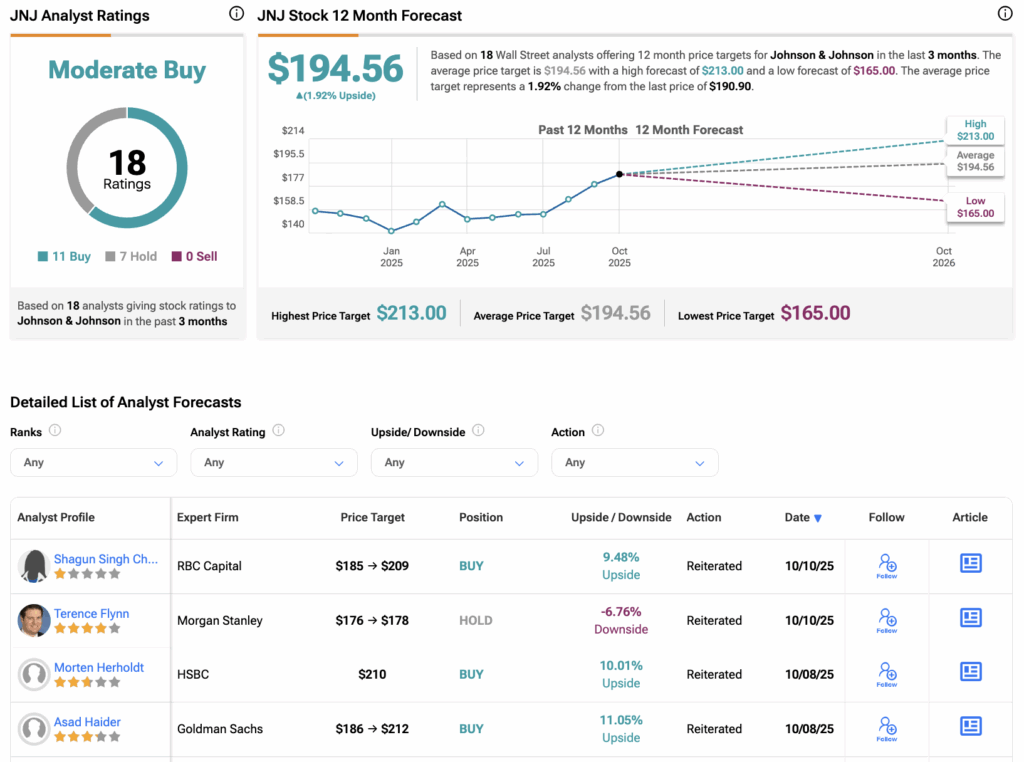

According to TipRanks, JNJ stock has received a Moderate Buy consensus rating, with 11 Buys and seven Holds assigned in the last three months. The average JNJ stock price target is $194.56, suggesting a potential upside of 1.92% from the current level.

These ratings and price targets will likely change as analysts update their coverage following today’s earnings report.