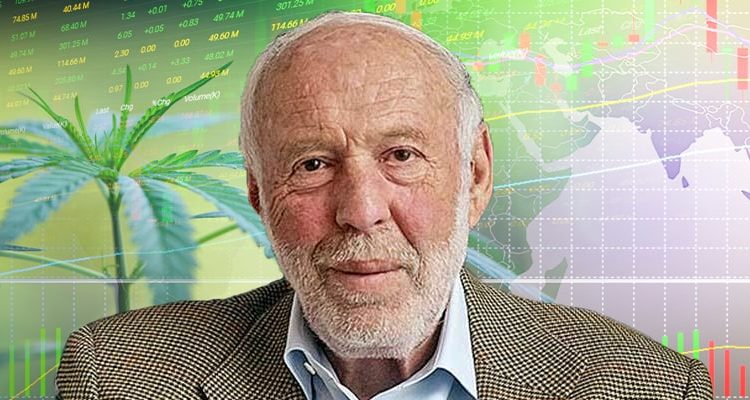

James Harris Simons, an American mathematician, philanthropist, and billionaire hedge fund manager of Renaissance Technologies, disclosed its portfolio holdings for the quarter ending September 30. A 13F-HR filing showed that Renaissance Technologies made major purchases of some of the big tech companies as follows:

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Micron Technology (NASDAQ:MU) – 7.47 million shares

- Alphabet Class A (NASDAQ:GOOGL) – 5.21 million shares

- Alphabet Class C (NASDAQ:GOOG) – 1.73 million shares

- Amazon.com (NASDAQ:AMZN) – 3.15 million shares

- Accenture PLC (NYSE:ACN) – 1.24 million shares

Renaissance Technologies, which claims to be one of the biggest and best-managed funds of all time has seen its portfolio shrink quarter over quarter. Owing to the unfavorable macro backdrop, Renaissance’s portfolio value fell to $70.68 billion as on September 30, from $84.47 billion at the end of June 30. While buying several stocks, Simons completely exited the positions in a few stocks, including those mentioned below:

- GlaxoSmithKline PLC (NYSE:GSK) – 9.98 million shares

- Oracle Corp. (NYSE:ORCL) – 1.39 million shares

- TJX Companies (NYSE:TJX) – 1.22 million shares

- Target Corporation (NYSE:TGT) – 1.10 million shares

- Keycorp (NYSE:KEY) – 1.11 million shares

Interestingly, Renaissance Technologies’ largest holding is Novo-Nordisk A/S (NYSE:NVO) (DE:NOVC), with 2.16% of the total portfolio. During Q3, Simons sold 2.22 million shares of Novo-Nordisk and currently holds 15.31 million shares of the biotechnology company, valued at $1.53 billion.

Denmark-based Novo-Nordisk is the leading provider of diabetes-care products in the world. Its offerings include a variety of human and modern insulins, injectable diabetes treatments, and oral antidiabetic agents.

Is Novo-Nordisk a Good Company?

Notably, Novo-Nordisk controls roughly 50% of the global insulin market. With a wide moat, it’s not surprising that Simons invests a large portion of his fund in the company. On TipRanks, DE:NOVC stock has a Moderate Buy consensus rating. This is based on six Buys, three Holds, and one Sell. The average Novo Nordisk price target of €113.23 implies 3.5% upside potential to current levels. Meanwhile, DE:NOVC stock has gained 15.8% so far this year.

Find out which stock the biggest hedge fund managers are buying right now.