Jim Cramer, the host of CNBC’s Mad Money, believes that Nvidia (NVDA) could change the way many industries work, and even how people think, in the next 10 years. On Yahoo Finance’s Opening Bid Unfiltered podcast, he said that the chipmaker is building something he calls a “chip reasoning platform,” which may be able to form opinions and make decisions that are better than those made by humans. For example, Cramer mentioned that law firms might not need as many junior lawyers anymore because the chip could handle some of their tasks more accurately.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

He compared the breakthrough to the work of astronomer Vera Rubin, who proved the existence of dark matter, a discovery that changed science forever. Interestingly, Cramer has believed in Nvidia for a long time. Back in 2017, most people thought Nvidia was just a gaming company, but that changed after Cramer visited CEO Jensen Huang. Indeed, he saw demos of AI creating art, theater, and restaurant scenarios, which were things that seemed “inconceivable” back then.

And while Nvidia’s stock has already soared more than 1,200% in the last five years, Cramer says that there’s still more room to grow. He believes the next phase of Nvidia could be even more life-changing than the last. However, there are still some challenges ahead. One concern is that Nvidia may need to sign licensing deals with companies like The New York Times (NYT) to use their data for AI training, which could affect how it operates.

What Is a Good Price for NVDA?

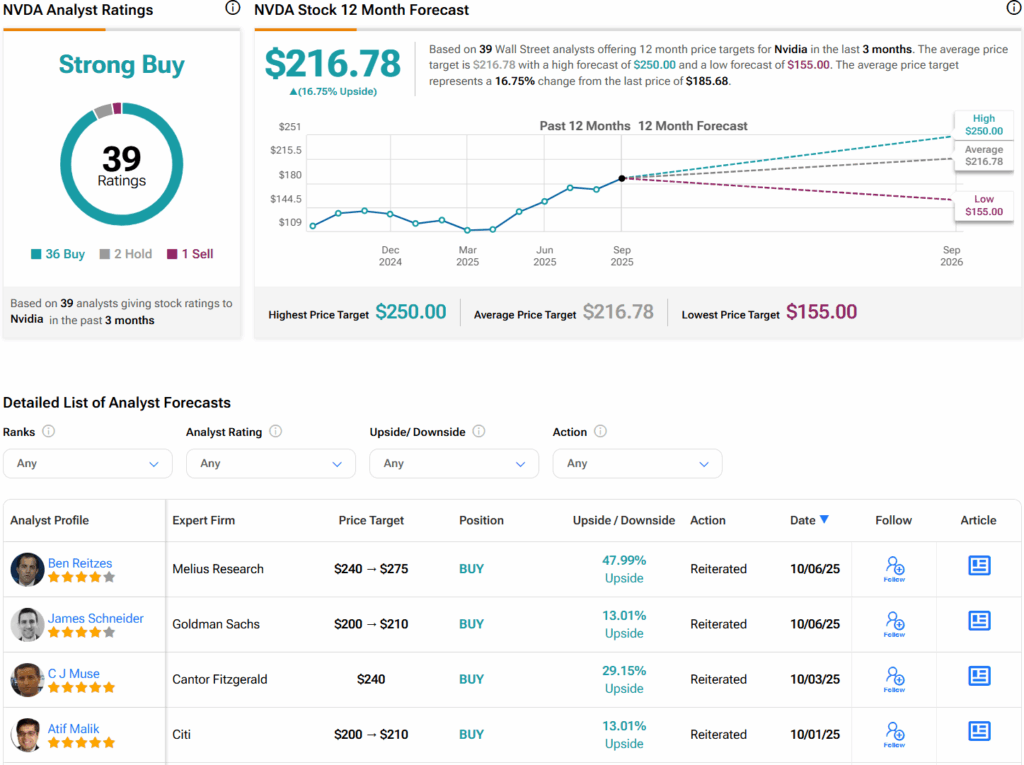

Turning to Wall Street, analysts have a Strong Buy consensus rating on NVDA stock based on 36 Buys, two Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average NVDA price target of $216.78 per share implies 16.8% upside potential.