Airline major JetBlue Airways Corp. (NASDAQ:JBLU) slid in pre-market trading after a downbeat outlook. The company expects its available seat miles (ASMs) to decline by 6% to 3% year-over-year in the first quarter, while it is likely to be down in low single digits in FY24. The company estimates revenues to drop in the range of 9% to 5% in the first quarter and has projected it to be flat year-over-year in FY24.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In FY24, the company anticipates to breakeven on an adjusted operating profit margin basis. JetBlue’s CFO, Ursula Hurley, emphasized that the company was intensely focused on restoring profitability and is evaluating deeper cost cuts alongside fleet modernization and structural programs.

In the fourth quarter, JetBlue posted operating revenue of $2.3 billion, down 3.7% year-over-year. Analysts were expecting Q4 revenues of $2.29 billion. In addition, it reported an adjusted net loss of $0.19 per share in the fourth quarter, narrower than analysts’ estimates of a $0.27 per share loss.

Is JBLU a Good Stock?

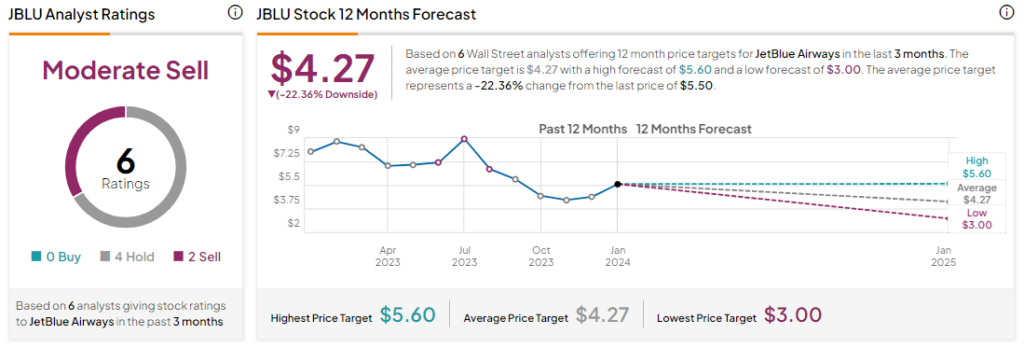

Analysts remain bearish about JBLU stock with a Moderate Sell consensus rating based on four Holds and two Sells. Over the past year, JBLU stock declined by 25%, and the average JBLU price target of $4.27 implies a downside potential of 22.4% at current levels.