With the Northeast Alliance now in tatters, JetBlue (NASDAQ:JBLU) is left to pick up the pieces of its future. That’s a task that just got that much harder with a new report from Evercore ISI, which cast a further pallor on JetBlue’s ultimate future and sent it down slightly in Tuesday afternoon’s trading.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Evercore, via analyst Duane Pfennigwerth, cut the overall rating on JetBlue from “in-line” to “underweight.” Though Pfennigwerth believes that the Spirit Airlines (NYSE:SAVE) deal will ultimately go through, there are other, bigger problems in line for JetBlue. Pfennigwerth noted that JetBlue’s balance sheet is having serious problems, heading rapidly from “average” to “worst” thanks to a rise in net debt from 2x to 5x. Moreover, the Spirit Airlines acquisition may cause as many problems as it solves, if not more, especially given the complexity of integration and JetBlue’s record in executing such transfers.

The combination of JetBlue’s hefty debt load and the $3.8 billion it will shell out to get hold of Spirit Airlines won’t be a winning combination either. However, there are some positive signs for JetBlue; one point that’s winning raves is JetBlue’s handling of meal service, especially on longer flights. JetBlue offers a wireless ordering system, which allows passengers to set up all their meals right from their seats. The meals are delivered later, as normal, but by having the passengers place their own orders, it streamlines the experience.

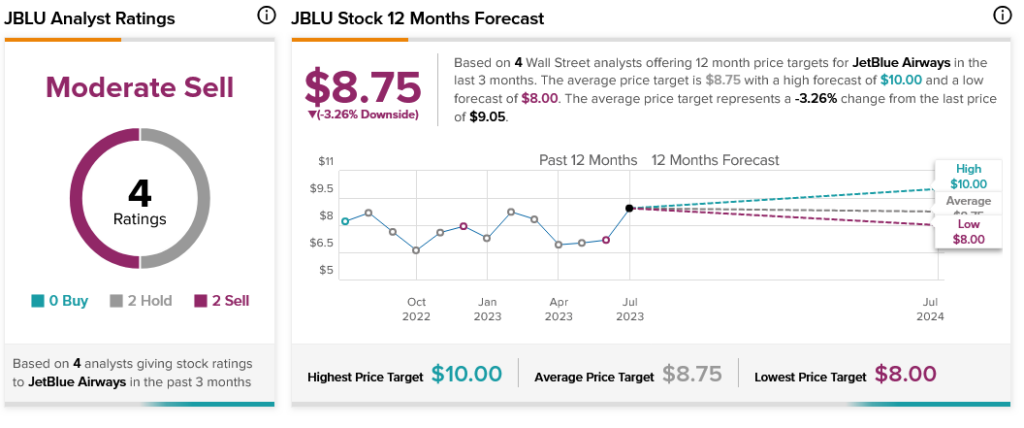

JetBlue certainly has some positives, but there are a lot of negatives weighing down the scale. That’s likely why analysts are split on just how bad off JetBlue actually is. Two Hold ratings and two Sell combine to make a Moderate Sell consensus on JetBlue stock. Further, JetBlue stock also comes with a 3.26% downside risk thanks to its average price target of $8.75.