American air carriers JetBlue Airways (NASDAQ:JBLU) and American Airlines (NASDAQ:AAL) will stop selling seats on each other’s airlines on Friday, July 21, following a federal court ruling passed in May. In early July, we reported that JetBlue had decided to unwind the Northeast Alliance (NEA) after a court ruling asked for a shutdown citing its anti-competitive nature. Both JBLU and AAL stocks have fallen in the past five days, as investors are likely wary of the fallout of the breakup. Additionally, airline stocks have been dropping since the Bureau of Transportation Statistics announced that airfares have been on a decline since March.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The codesharing (passenger and revenue sharing) deal between JBLU and AAL began in early 2021. It allowed customers to book flights on either airline in the Boston and New York regions, where air traffic and passenger footfalls remain highly busy. The agreement gave them leeway to better manage their flights in the NEA and compete efficiently with bigger rivals like United Airlines (NASDAQ:UAL) and Delta Air Lines (NYSE:DAL). However, following the wind-down process, customers can now book seats on the NEA only until July 20. Also, the loyalty benefits associated with the same can be claimed only until this Thursday. However, customers who have already booked tickets for the coming months may feel secure knowing the travel schedules, JetBlue said in a statement.

After the termination of the deal, JetBlue has committed to focusing on its pending $3.8 billion acquisition of ultra-low-cost carrier Spirit Airlines (NYSE:SAVE), which is also facing regulatory issues. JetBlue and American Airlines do not agree with the federal court’s ruling, but AAL is contemplating contesting the ruling shortly.

What is the Target for JBLU Stock?

On TipRanks, JetBlue has a Moderate Sell consensus rating. This is based on three Hold and two Sell ratings. Also, the average JetBlue Airways price forecast of $8.60 implies 6.8% upside potential from current levels. JBLU stock is up 23.9% so far this year, but down 11.8% in the past five days.

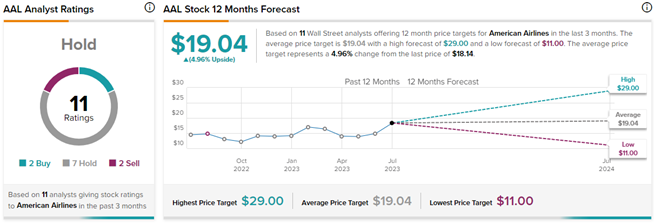

What is the AAL Price Target?

On TipRanks, the average American Airlines price target of $19.04 implies nearly 5% upside potential from current levels. AAL stock has a Hold consensus rating based on two Buys, seven Holds, and two Sell ratings. Meanwhile, year-to-date AAL stock has gained 42.4%, but has fallen by 4.9% in the past five days.