Chinese online retailer PDD Holdings (NASDAQ:PDD) gained in trading after Jeffries analyst Thomas Chong upgraded the stock. The analyst upgraded PDD to a Buy from a Hold with a price target of $157, implying an upside potential of 37.9% at current levels. PDD owns the Chinese platform Pinduoduo and the U.S. platform Temu.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Chong cited the company’s rising market share in both domestic and international markets and its resilient business model. Furthermore, the analyst believes that geopolitical concerns for the stock are already priced in. Many analysts have highlighted the rising geopolitical tensions between the U.S. and China as a rising risk for the stock.

Chong expects PDD’s strong growth to continue in the fourth quarter when it reports its results later this month, with revenue likely to more than double annually.

Is PDD a Good Stock to Buy?

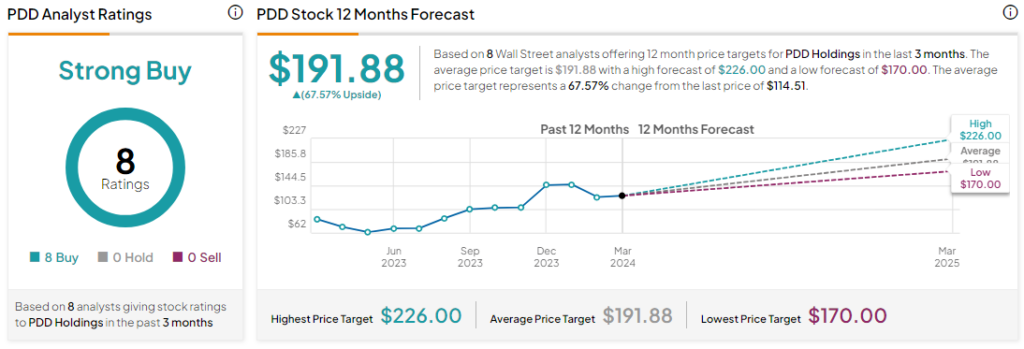

Analysts remain bullish about PDD stock with a Strong Buy consensus rating based on eight Buys. Over the past year, PDD has soared by more than 20%, and the average PDD price target of $191.88 implies an upside potential of 67.6% from current levels.