Boutique investment bank Jefferies Financial Group (JEF) has reported record quarterly financial results as deals on Wall Street come roaring back.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The bank said in its earnings release that it had its best quarter ever due to a rising number of mergers and acquisitions and initial public offerings (IPOs) taking place this year. For what was its Fiscal third quarter, Jefferies reported earnings per share (EPS) of $1.01, which beat the $0.80 expected by analysts. The bank’s profit was up 34% from a year earlier.

Revenue in the period totaled $2.05 billion, which topped the $1.90 billion that was forecast on Wall Street. Jefferies said the $656 million of revenue from the investment-banking advisory business marked its best performance on record.

Jefferies’ earnings per share. Source: Main Street Data

Strong Performance

The strong results mark a rebound from the previous quarter when Jefferies reported earnings that fell short of Wall Street’s expectations. In the latest earnings report, Jefferies CEO Richard Handler said the higher revenue came largely from the investment bank’s advisory work on deals.

Management added that it continues to benefit from “an improvement in the environment for mergers and acquisitions and capital formation.” Wall Street deals have come storming back this year after being in the doldrums since the 2022 bear market that was caused by high inflation and rising interest rates.

JEF stock is down 13% this year.

Is JEF Stock a Buy?

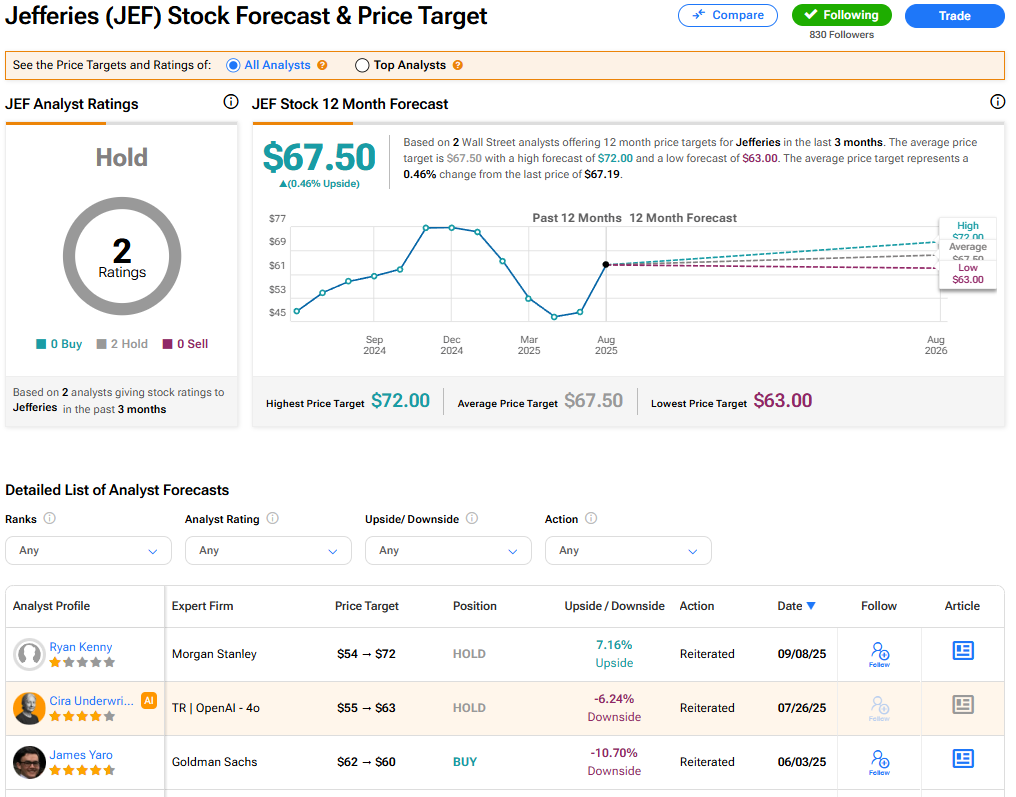

The stock of Jefferies Financial Group has a consensus Hold rating among two Wall Street analysts. That rating is based on two Hold recommendations issued in the last three months. The average JEF price target of $67.50 implies 0.46% upside from current levels. These ratings could change after the company’s financial results.