JD.com’s (JD) second-quarter earnings report has caused quite a stir, with its stock soaring by 6.4% following the announcement. The company reported net revenues of RMB291.4 billion (approximately US$40.1 billion), reflecting a modest 1.2% increase from the previous year and aligning closely with analysts’ consensus estimate of RMB291.47 billion. This uptick in revenue reflects JD.com’s solid market position amidst a competitive landscape.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

JD’s Earnings Per Share (EPS) Skyrocket

JD.com’s earnings per share (EPS) showed a remarkable jump in the second quarter. Diluted net income per ADS surged by 97.3% to RMB8.19 (US$1.13), a significant leap from RMB4.15 in the same period last year. The company’s non-GAAP diluted EPS also saw a 73.7% rise to RMB9.36 (US$1.29), exceeding analysts’ consensus estimates of US$0.87. As Sandy Xu, JD.com’s CEO, put it, “Our steadfast efforts to strengthen supply chain capabilities and user experience continue to distinguish JD in China’s e-commerce industry.”

JD.com’s Profit Margins and Operating Income Shine

JD.com’s income from operations for Q2 reached RMB10.5 billion (US$1.4 billion), up from RMB8.3 billion last year. The non-GAAP income from operations also saw a significant boost, climbing to RMB11.6 billion (US$1.6 billion). This increase in operating income reflects the company’s improved gross margin, which jumped by 137 basis points to 15.8%. Ian Su Shan, CFO of JD.com, highlighted that “our gross margin substantially increased… contributing to our record-high operating and net profit on a non-GAAP basis.”

JD’s Share Repurchases Underline Confidence

In a show of confidence, JD.com repurchased 136.8 million Class A ordinary shares (equivalent to 68.4 million ADSs) for US$2.1 billion during the second quarter. This move, part of a larger US$3.0 billion share repurchase program, demonstrates the company’s commitment to boosting shareholder value and mitigating potential dilution from convertible senior notes issued earlier this year.

Is JD a Good Stock to Buy?

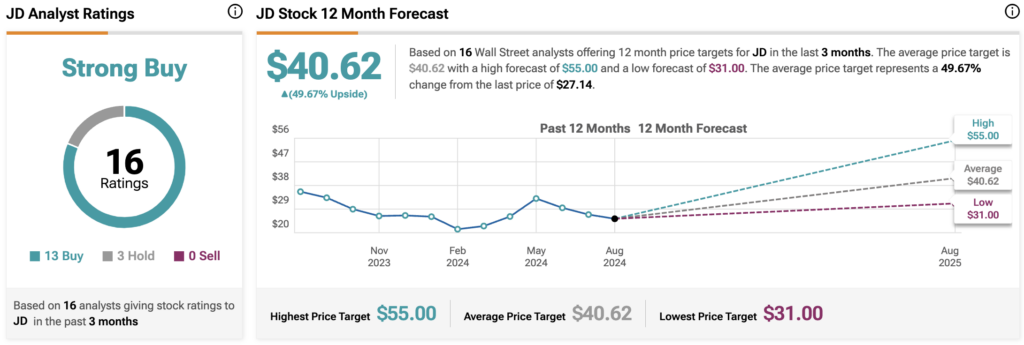

Analysts remain bullish about JD stock, with a consensus Strong Buy rating based on 13 Buys and three Holds. Over the past year, JD has decreased by more than 20%, and the average JD price target of $40.62 implies an upside potential of 49.7% from current levels. These analyst ratings are likely to change following JD’s results today.