JD.com (NASDAQ:JD) recently made considerable progress in the artificial intelligence (AI) space by introducing a large language model (LLM) named ChatRhino for enterprise use. Initially, the ChatRhino model will be deployed within JD.com’s E-commerce, Logistics, and marketing units.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company aims to offer ChatRhino to its enterprise clients beginning in the first half of 2024. Furthermore, the company has plans to launch another LLM platform for its developers, which is expected to be unveiled in the coming month.

Earlier this year, JD also disclosed plans to launch ChatJD, an AI product with a focus on industrial applications, specifically in retail and finance. With this product, JD.com aims to leverage AI technology to enhance various aspects of content creation and enable seamless communication between humans and computers.

U.S.-China AI Race

JD.com remains engaged in fierce competition with domestic rivals like Alibaba Group (BABA), which recently launched its own ChatGPT-style technology called Tongyi Qianwen. Similarly, Baidu (BIDU), a prominent Chinese search giant, introduced its AI chatbot named Ernie Bot in March 2023. These developments highlight the ongoing race among Chinese tech companies to leverage AI technologies.

However, there is a bigger race that is ongoing between two of the world’s largest economies: the United States and China. OpenAI’s ChatGPT launch has triggered an AI frenzy, prompting substantial investments in the development of AI tools by tech companies.

This race reflects the potential of AI and the desire of these countries to lead in this field. It is worth highlighting that China is planning to mandate license applications for all companies working with generative AI. By implementing this measure, China aims to foster innovation while ensuring that AI technology is developed and used in a responsible manner.

Is JD Stock a Buy, Sell, or Hold?

Currently, analysts have a Strong Buy consensus rating on JD stock. This is based on 13 Buy and three Hold recommendations. The average price target of $59.58 implies 59.26% upside potential from the current level. The stock is down about 34% so far in 2023.

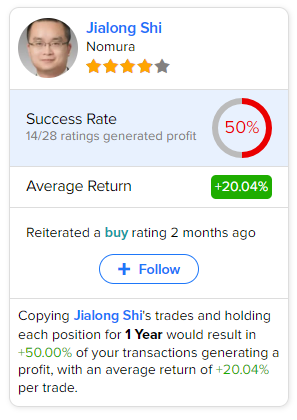

As per TipRanks data, the most accurate and profitable analyst for JD.com is Nomura analyst Jialong Shi. Copying the analyst’s trades on this stock and holding each position for one year could result in 50% of your transactions generating a profit, with an average return of 20.04% per trade.