Chinese e-commerce giant, JD.com (NASDAQ: JD) slid at the time of writing on Wednesday as worries persisted among investors regarding a slowdown in the Chinese economy. The latest economic data from China has indicated that its imports and exports are declining at a faster pace than expected. While the country’s imports contracted by 12.4% in July, more than an estimate of a decline of 5%, exports fell by 14.5% versus economists’ forecast of a decline of 12.5%.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Meanwhile, JD.com reported second-quarter adjusted earnings of $0.74 per diluted share and ahead of analysts’ estimates of $0.68 per share.

The company’s revenues increased by 7.6% year-over-year to $39.7 billion, beating Street estimates of $38.68 billion.

Ian Su Shan, JD.com’s CFO commented, “JD.com delivered both revenues and profitability ahead of our expectation in the second quarter, an encouraging trend we are happy to see amidst our business adjustment and a highly competitive market environment. In JD Retail, we continued to gain market share in core categories of home appliances and 3C, propelled by our supply chain advantages and service quality, while supermarket category made steady progress as expected to build a healthier business model.”

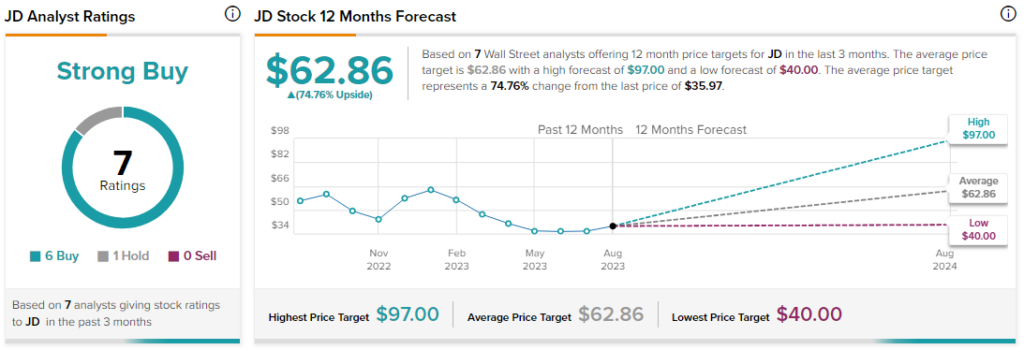

Analysts are bullish about JD stock with a Strong Buy consensus rating based on six Buys and one Hold.