After closing lower on the OTC market on Tuesday, Japanese stocks fell in today’s trading session on the Tokyo Stock Exchange as their Q3 earnings irked investors. Shares of SoftBank (SFTBY)(GB:0L7L), which invests money in startups through its popular Vision Fund, have fallen over 5%. Meanwhile, shares of videogame company Nintendo (NTDOY)(GB:0K85) are down more than 7%. Moreover, Sharp (SHCAY)(DE:SRPB), which manufactures electronic components and consumer electronics, saw its stock decline by 12%.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

What is the Issue with SoftBank Stock?

The issue with SoftBank is the continued weakness in its investment arm, the Vision Fund. The investment division has posted a loss for the fourth consecutive quarter. SoftBank’s Vision Fund posted a cumulative quarterly loss of over $5.1 billion. This didn’t sit well with the investors.

This investment loss reflects the drop in the share prices of the portfolio companies in Q3. Additionally, it includes the valuation losses for the private portfolio companies.

The Softbank stock has a Hold recommendation from J.P. Morgan analyst Haruka Mori. Meanwhile, it carries a Neutral Smart Score of six on TipRanks.

Is It Good to Buy Nintendo Stock?

Nintendo’s sales and earnings declined in the third quarter. Meanwhile, the company reduced its full-year revenue and profit outlook. Nintendo expects Switch hardware and software unit sales to decline and weigh on the company’s overall financials.

The Switch division saw overall volumes decline in Q3. Meanwhile, the soft unit fell by 4%.

Earlier, Mori downgraded Nintendo stock because the company lacked next-generation hardware. Nevertheless, Nintendo has received positive signals from bloggers and sports an Outperform Smart Score of eight.

What Is the Prediction for Sharp Stock?

The significant decline in operating and net profit took a toll on Sharp’s stock. The company said that the weakened Yen and ongoing sluggishness in the Display Device segment weighed on its profitability. Furthermore, Sharp lowered its forecast and expects to report a loss in Fiscal 2022.

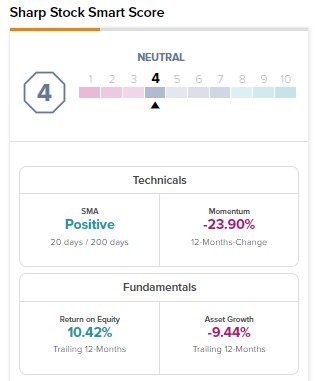

Given the near-term headwinds, Sharp stock has a Neutral Smart Score of four on TipRanks.