Fast-food restaurant chain Jack in the Box, Inc. (JACK) and California-based Del Taco Restaurants, Inc. (TACO) have signed an agreement under which the former will acquire the latter for nearly $575 million cash, including debt.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Following the announcement, shares of Del Taco closed over 66% higher on Monday. Meanwhile, shares of Jack in the Box closed 4.1% down but gained 1.6% in the extended trading session to end the day at $81.86.

Impact of the Acquisition

Once the acquisition is complete, which is expected in the first quarter of next year, the combined company will have more than 2,800 restaurants spread across 25 U.S. states. (See Insiders’ Hot Stocks on TipRanks)

Jack in the Box expects the transaction to be accretive to earnings per share (EPS) in mid-single-digit in the first year and meaningfully accretive from the second year.

Further, Jack in the Box anticipates the transaction to generate cost synergies of around $15 million by the end of Fiscal Year 2023. It expects to achieve these synergies through knowledge-sharing initiatives, technology and digital efficiencies, and procurement and supply chain savings.

Management Comments

The CEO of Jack in the Box, Darin Harris, said, “Together, Jack in the Box and Del Taco will benefit from a stronger financial model, gaining greater scale to invest in digital and technology capabilities and unit growth for both brands. This acquisition fits squarely in our strategic pillars and helps us create new opportunities for the franchisees, team members and guests of both brands.”

“We can leverage our infrastructure, experience refranchising, and development strategy to support Del Taco’s growth plans and expand Del Taco’s footprint,” Harris added.

The President and CEO of Del Taco, John D. Cappasola, Jr., said, “We expect this transaction will provide Del Taco with the scale, complementary capabilities and opportunity to become even stronger partners to our franchisees and support their ability to drive substantial growth in our core and emerging markets.”

About Jack in the Box

Headquartered in California, Jack in the Box runs a chain of quick-service restaurants (QSR). It has over 2,200 locations across the West Coast of the U.S. The company’s offerings include a variety of French fries and chicken tenders, cheeseburger and hamburger sandwiches as well as internationally-themed foods.

About Del Taco

Del Taco operates a chain of Mexican QSRs and has approximately 600 restaurants spread across 16 states. Its menu includes American-style Mexican cuisine such as tacos and burritos, along with American dishes like burgers, fries and milkshakes.

Wall Street’s Take on Jack in the Box

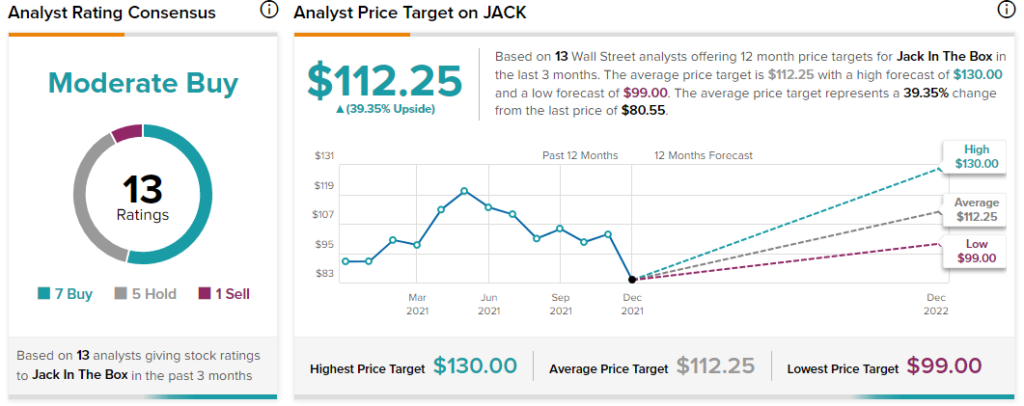

After the acquisition was announced, Deutsche Bank (DB) analyst Brian Mullan upgraded the rating on the stock to Buy from Hold but lowered the price target from $122 to $108 (34.1% upside potential).

The analyst is of the view that this deal makes both financial and strategic sense.

Overall, the stock has a Moderate Buy consensus rating based on 7 Buys, 5 Holds and 1 Sell. The average Jack in the Box price target of $112.25 implies 39.4% upside potential. Shares have lost 30.6% over the past six months.

Wall Street’s Take on Del Taco

Following the announcement of the deal, Wedbush analyst Nick Setyan downgraded the rating on the stock from Buy to Hold and reduced the price target to $12.50 from $15.

The analyst said, “The new price target reflects the high probability of the Jack in the Box deal closing.”

Also, he does not expect any competing bids.

Overall, the stock has a Moderate Buy consensus rating based on 1 Buy and 2 Holds. The average Del Taco Restaurants price target of $12.83 implies 2.6% upside potential. Shares have gained nearly 40% year-to-date.

Risk Analysis of Del Taco

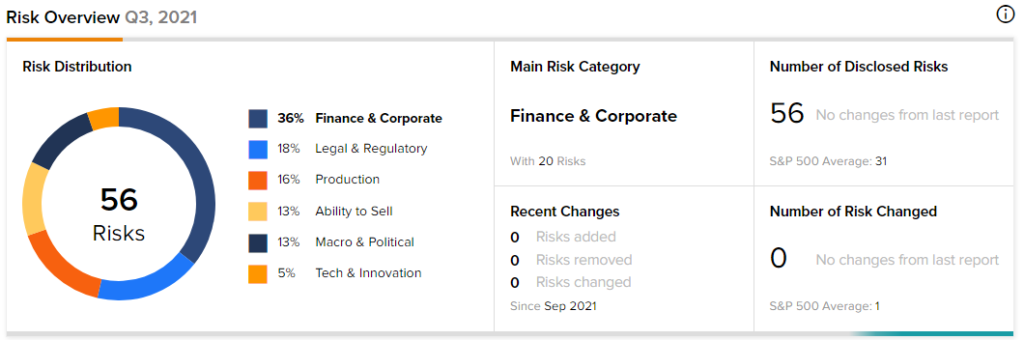

According to TipRanks’ Risk Factors tool, Del Taco is at risk mainly from one factor: Finance & Corporate, which accounts for 36% of the total 56 risks identified for the stock. Under the Finance & Corporate risk category, the company has 20 risks, details of which can be found on the TipRanks website.

Related News:

Sysco to Acquire Coastal Companies; Shares Rise 4.3%

Dye & Durham Buys TELUS Financial Solutions Business

Voltas Ventures into European Markets