Shares of manufacturing services and solutions provider Jabil (NYSE:JBL) are ticking higher today after the company delivered a better-than-anticipated first-quarter performance. Despite a nearly 13% year-over-year decline, revenue of $8.4 billion outpaced expectations by $50 million. Further, EPS of $2.60 surpassed estimates by $0.02.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company witnessed a softening demand during the quarter. Still, gross profit increased by $32 million to $775 million. Additionally, cash flow from operating activities increased to $448 million from $166 million in the year-ago period. At the same time, the company was able to lower the cash flow used in investing activities to $75 million from $176 million in the comparable year-ago period.

Looking ahead to Fiscal year 2024, Jabil expects an EPS of $9+ on revenue of nearly $31 billion. Adjusted free cash for the year is anticipated to be $1+ billion. For the upcoming quarter, the company expects revenue to be in the range of $7 billion to $7.6 billion. EPS for the quarter is seen landing between $1.73 and $2.13.

Is JBL a Good Investment?

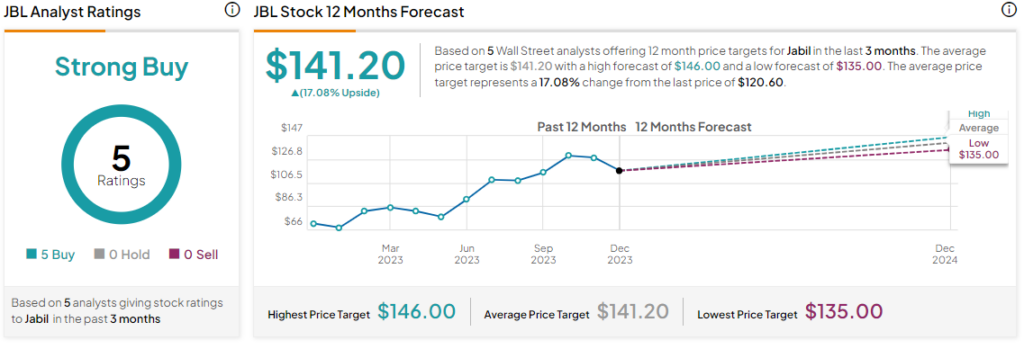

Overall, the Street has a Strong Buy consensus rating on Jabil, and the average JBL price target of $141.20 implies a 17.1% potential upside in the stock. That’s on top of a 66% surge in the company’s share price over the past year.

Read full Disclosure