Tesla, Inc. (NASDAQ:TSLA) shareholders left little doubt regarding their views of CEO Elon Musk, approving his massive compensation package by an overwhelming majority at the company’s recent shareholder meeting.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Never one to mince words, Musk met the moment with his usual swagger, proclaiming that a new day has dawned for Tesla and its ambitions.

“What we are about to embark upon is not merely a new chapter of the future of Tesla, but a whole new book,” declared the world’s richest man.

Tesla has its eyes on a number of lucrative opportunities, notably the launch of a fleet of self-driving robotaxis and autonomous robots. With a fully motivated Musk placing both hands on the steering wheel, is now the time for investors to also climb aboard?

Top investor Steven Fiorillo certainly appreciates all the excitement.

“This is now a story of execution as TSLA has the framework to become not just the most valuable company but the most important company in the market,” says the 5-star investor, who is among the very top 1% of stock pros covered by TipRanks.

Fiorillo is encouraged by Musk’s track record, noting the CEO’s “solid” history of success. The investor has bought into Musk’s $8.5 trillion blueprint for Tesla, and believes it could very well come to fruition.

In Fiorillo’s opinion, the Optimus platform represents the biggest potential bonanza for Tesla. The investor points out that 10 million units per year – selling at $20,000 – would bring in $200 billion in annual revenues. Add in a monthly service fee, and the hypothetical figures become even more exciting.

Combined with advances in Full Self-Driving (FSD) and proprietary AI chips, Tesla could be on the cusp of “exponential revenue potential,” according to Fiorillo.

However, there’s another side of the coin.

The big knock against Tesla is its “excessive” valuation, which Fiorillo notes is significantly higher than its technology peers. That’s where the bear and bull arguments tend to break down for this “battleground stock,” details Fiorillo, as the optimists focus on the future vision while the pessimists are mired in the current valuation.

For Fiorillo, the valuation has stretched a bit too far, and he is therefore assigning TSLA a Neutral (i.e. Hold) rating. However, Fiorillo charts a path for how this could change.

“If Elon can show significant progress on Optimus and FSD over the next several quarters I will happily upgrade my investment thesis to bullish,” sums up Fiorillo. (To watch Steven Fiorillo’s track record, click here)

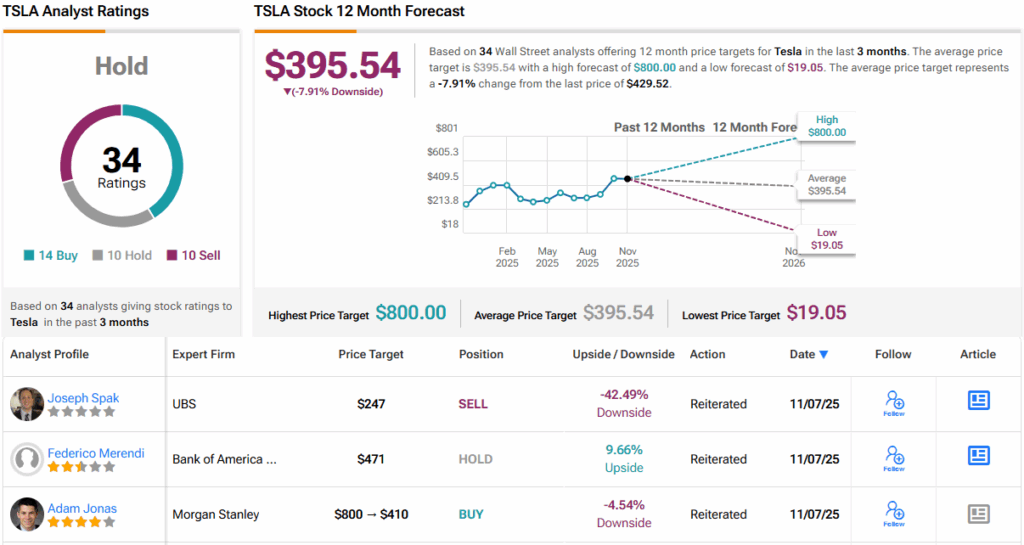

As Fiorillo mentions, TSLA provokes a wide range of opinions, with price targets ranging vastly from a Street-high $800.00 to a low of $19.05. Its 14 Buys, 10 Holds, and 10 Sells give TSLA a consensus Hold rating, while a 12-month average price target of $395.54 implies a downside in the high single digits. (See TSLA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.