For anyone who has priced a pickup truck lately, you know from bitter experience that they are super expensive these days. Even the used ones are pricey. But legacy automaker Ford (F) has something like a plan to help, even if the plan does not fix the problem so much as it does accommodate those who suffer from it. Ford has a new financing plan in mind for F-150 buyers, and investors were not pleased. Ford shares slid modestly in Wednesday afternoon’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Basically, Ford is stepping back into the subprime credit market, offering new offers to those with a credit score of under 620. These promotional deals are not unheard of, and are sometimes used as a means to pare down excess inventory. The F-150 may be suffering from such a fate; while sales were up 12.7% against September 2024, they were down 3.4% against August 2024. And with F-150 prices running from around $39,000 to the low six figures, it might be that Ford has some trucks it wants out of dealer inventory with a new model year approaching.

Ford, perhaps trying to reassure skittish shareholders, noted, “We only finance customers we believe are creditworthy and have the capacity to pay. We have done these types of national programs in the past, extending a promotional rate to customers who meet our credit criteria.” And with higher-risk consumers only accounting for less than 4% of all financing since 2024, this may be valid.

“Auto Design Renaissance”

Meanwhile, Ford’s plan to move its headquarters is starting up something interesting, reports note. While Ford’s staff is optimistic about the move, so are those connected to it tangentially, like Ford dealers. Village Ford owner Jim Seavitt noted, “The World Headquarters building is 70 years old and I’ve heard stories of it decaying from the inside and it needs one large root canal. So making this move makes all the sense in the world to me.”

It is also said to be having an impact on Ford design operations, as the new building will offer up a lot more in the way of natural light than its predecessors ever did. And with Ford increasingly focused on a “no boring cars” stance, it will need plenty of new ideas to ensure that stance can be followed.

Is Ford Stock a Good Buy Right Now?

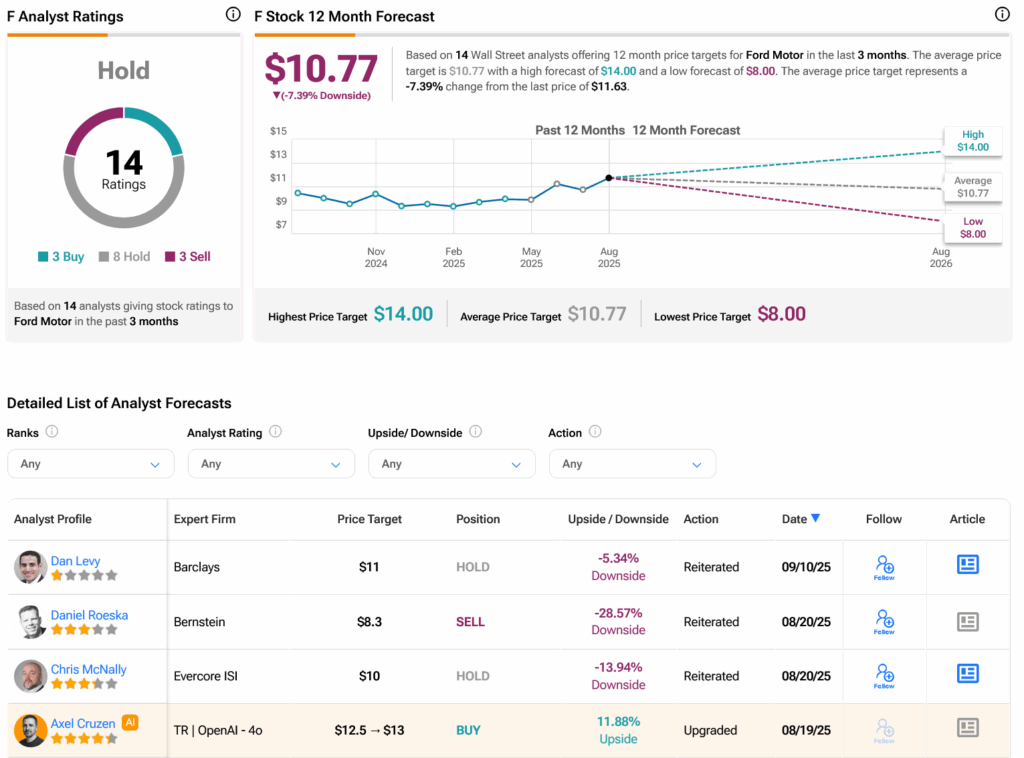

Turning to Wall Street, analysts have a Hold consensus rating on F stock based on three Buys, eight Holds and three Sells assigned in the past three months, as indicated by the graphic below. After a 12.57% rally in its share price over the past year, the average F price target of $10.77 per share implies 7.39% downside risk.