There have been many over the years who have claimed war is good for business. While it depends largely on what business you’re talking about, defense stocks certainly tend to do well in the midst of war. The Israel-Hamas war, now nearly two weeks old, is no exception, if only for the most part. Several major defense stocks have seen impressive gains in this time, but it’s not exactly universal.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

A look at the last five days in trading for several defense stocks generally shows upward momentum. Lockheed Martin (NYSE:LMT), for example, started out down around $434.74. However, by the 17th, it breached the $450 mark but lost briefly in that time. A rally followed, and shares were back up, but never quite enough to breach $450 as it did previously. Meanwhile, Northrup (NYSE:NOC) saw a similar pattern, spending most of the week between the $485 and $495 mark.

Raytheon (NYSE:RTX) saw a much more upward pattern over the last five days, and though it also suffered a bit of a slump around the 18th, it didn’t take long for a recovery to set in. However, it too couldn’t break the high-water mark it set on October 17th. Finally, we have the lone exception, General Dynamics (NYSE:GD), which has been on a fairly steady decline since the 16th. General Dynamics hasn’t enjoyed any surprise rallies, and any upward momentum seen in trading has not lasted long.

What are the Best Defense Stocks to Buy Now?

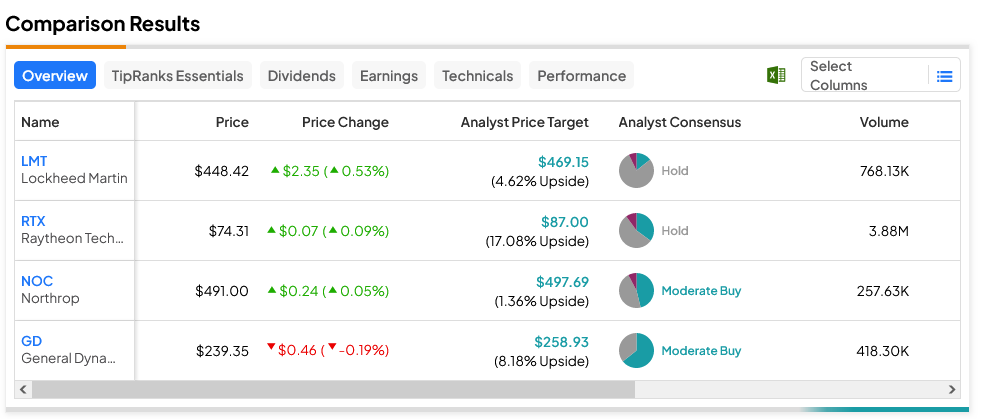

Turning to Wall Street, while GD stock may have been the laggard today, it actually boasts the second-highest upside potential at 8.18% with an average price target of $258.93. Meanwhile, RTX stock, a Hold by analyst consensus, boasts the strongest upside potential at 17.08% against its average price target of $87.