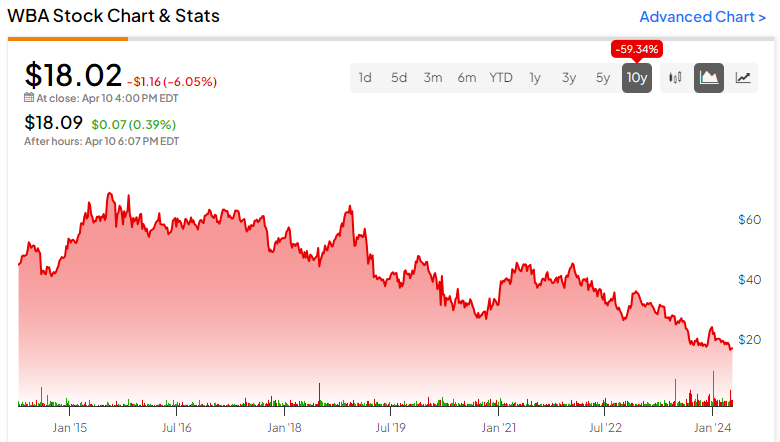

Walgreens stock (NASDAQ:WBA) is currently trading at 26-year lows, following a continuous decline over the past nine years. The main driver of this prolonged decline is Walgreens’ worsening profitability, which ultimately led to a dividend cut in January. With the cut ending its 47-year dividend growth track record, panic ensued amongst Walgreens’ traditional, income-oriented shareholder base, causing steeper share price losses lately. Still, I don’t see any noteworthy catalysts to reverse the current sentiment. Thus, I am neutral on the stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Results Remain Weak, With Profit Margins Set to Remain Thin

For me, the primary factor preventing a turnaround in investor sentiment toward Walgreens stock is the ongoing weakness in the company’s results. More importantly, I am concerned about Walgreens’ razor-thin profit margins, which significantly reduce the likelihood of improving its heavily indebted balance sheet. A look at the company’s most recent Q2-2024 results illustrates my argument.

Sales Growth Hardly Matters

On the surface, Walgreens posted growing sales, but this increase in sales failed to translate to increasing profits. Total sales increased 6.3% year-over-year, or 5.7% in constant currency, to $37.1 billion. This growth was powered by an increase in sales across the board, including U.S. Retail Pharmacy sales growth of 4.7%, International sales growth of 3.2%, and U.S. Healthcare sales growth of 14%.

However, sales growth hardly matters, as Walgreens’ ever-present issue, razor-thin margins, continues to hamper its profitability prospects. In particular, Walgreens’ Pharmacy adjusted gross profit slipped due to the division’s margin being impacted by a less favorable brand mix and pressure from reimbursements. Its Retail gross margin also declined year-on-year, affected by higher shrink (i.e., any unaccounted loss of inventory), which in Walgreens’ case was caused by higher levels of theft in its retail locations.

Margins to Remain Depressed

Consequently, Walgreens’ gross margin for the quarter was just 19.0%, down from 20.2% in Q2 2023. Its adjusted operated margin was, therefore, further compressed to just 2.2%, down from 3.2% last year.

This trend is likely to persist moving forward, especially following the recent weakness in the VillageMD division. To elaborate, back in February, VillageMD’s management informed Walgreens that they had lowered their guidance and that they would be closing about 160 clinics. This led Walgreens to record a $5.8 billion impairment charge related to VillageMD goodwill. With this shakeup likely to prevent any operating efficiency headways, margins are likely to stay low for now.

WBA’s Balance Sheet to Remain Highly Indebted

Another reason likely to prevent a change in investor sentiment is the idea that Walgreens’ weak bottom line prevents balance sheet improvements. In fact, I believe that Walgreens’s balance sheet is poised to remain highly indebted, as the company lacks the cash flow to deleverage at a meaningful pace.

The company’s operating cash flow came in at negative $918 million in the first six months of Fiscal 2024, impacted by nearly $700 million of expenditures regarding legal matters and $380 million in premium contributions related to Boot’s pension plan. Thus, Walgreens’ net debt remained close to $34 billion at the end of the period.

WBA’s Dividend Isn’t Attractive Post-Cut

Walgreens’ dividend cut in January was a crucial move to improve the company’s cash flow profile. That said, the post-cut dividend is hardly attractive today. Despite the stock price’s prolonged decline pushing the yield up to 5.5%, this is a less than appealing capital return, particularly given Walgreens’ profitability and cash flow uncertainties in a market where interest rates hover above 5%.

For this reason, I believe it’s highly improbable that dividend investors will flock back to Walgreens stock anytime soon, especially given the lack of trust in the dividend after the 47-year dividend growth track record came to an end.

Is WBA Stock a Buy, According to Analysts?

Wall Street seems polarized about Walgreens Boots Alliance stock. The stock now features a Hold consensus rating based on one Buy, five Holds, and three Sell ratings assigned in the past three months. At $24.78, the average WBA stock forecast implies 29.53% downside potential, nonetheless.

If you’re unsure analyst to follow if you are looking to buy or sell WBA stock, Lisa Gill from JPMorgan (NYSE:JPM) stands out as the most accurate over a one-year period. She features an average return of 15.95% per rating and an impressive 55% success rate. Click on the image below to learn more.

The Takeaway

Walgreens’ over-extended share price decline may suggest that the stock could finally be attractive. However, the company continues to grapple with profitability issues and a heavily indebted balance sheet.

In the meantime, despite management’s efforts to improve cash flow, including cutting the dividend, I don’t see any catalyst that could fuel a change in Wall Street’s bearish sentiment. Thus, while I don’t deny the possibility of a rebound in the share price, such a scenario appears to remain highly unlikely.