Palantir Technologies (NASDAQ:PLTR) has been proving cynics wrong left and right during its blazing path to the peak of the AI mountaintop over the past few quarters. The big data analytics company continues to deliver sizzling numbers, including during its most recent Q2 2025 earnings report.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Indeed, Palantir can now boast quarterly revenues that are north of $1 billion, a year-over-year increase of 48%. Along the way, PLTR’s share price has also experienced a rapid increase, surging forward by some 380% over the past 12 months.

The biggest caveat regarding PLTR is its valuation, as its multiples soar above its industry peers by wide margins. Therein lies the rub, as critics of Palantir worry that much of its future growth is already priced into its share price.

That begs the question: how sustainable is Palantir’s ongoing ride at the top? One investor known by the pseudonym Quantryon Capital believes it has the potential to last quite a while.

“My view is that Palantir has evolved from a misunderstood government contractor to a successful software franchise that melds hyperscale growth with sustainable profitability,” explains the investor.

Quantryon asserts that Palantir has become an institutional operating system for enterprise AI. With a global AI market projected to grow to $3.68 trillion by 2034, the investor notes that a vast untapped potential for PLTR is beckoning.

The company is particularly well-placed due to its unique ontology-first model, posits the investor. This distinguishes PLTR from hyperscaler APIs, which offer generic model hosting or inference, further details Quantryon.

“Palantir enables institutions to re-platform entire operations on its ontology,” emphasizes the investor, who adds that this creates an elevated level of stickiness to Palantir’s contracts.

Nor is Quantryon too concerned about PLTR’s valuation, calling it “less speculative and more scarcity-driven.” The investor explains that there simply aren’t many other companies that combine its growth rates, rock-solid balance sheet, and “ontology-driven stickiness.”

“I believe Palantir remains one of the best ways to own the institutional infrastructure of the AI economy,” sums up Quantryon Capital, who rates PLTR a Strong Buy. (To watch Quantryon Capital’s track record, click here)

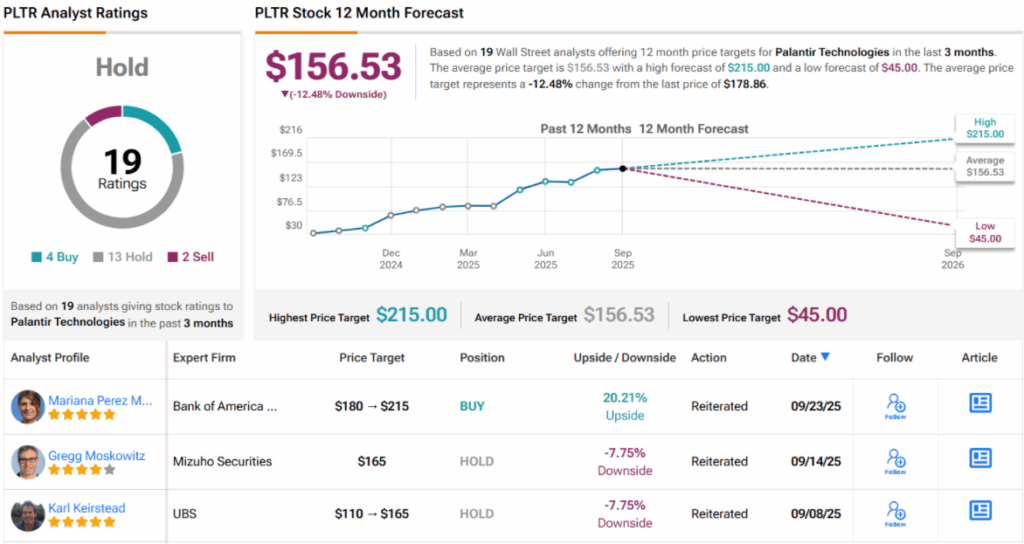

Wall Street, on the other hand, is a bit more tepid. With 13 Hold ratings – to go along with 4 Buys and 2 Sells – PLTR carries a consensus Hold (i.e. Neutral) rating. Its 12-month average price target of $156.53 implies losses in the low double-digits. (See PLTR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.