Nvidia (NASDAQ:NVDA) has been the driving force propelling the AI revolution forward, reaping the rewards of this modern-day gold rush over the past few years.

Yet, even the most powerful engines can sputter when markets overheat. Some raindrops are beginning to poke through the AI story, with fears of a bubble starting to percolate. Indeed, while billion-dollar deals make headlines almost daily, questions about the circular nature of these partnerships are mounting.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Take, for instance, last month’s megadeal between Nvidia and OpenAI. Nvidia plans to invest up to $100 billion in the ChatGPT maker – money that OpenAI will use to build and deploy 10 gigawatts of data centers powered by Nvidia GPUs.

It’s precisely this kind of arrangement that has some observers uneasy, warning that too much financial overlap among key players could inflate valuations in an industry still struggling to demonstrate sustainable profits.

Even so, not everyone is worried. Top investor Keithen Drury remains convinced that more “massive growth” lies ahead for AI, and that Nvidia will continue to be front and center.

“Nvidia’s stock could be cheap if the AI megatrend progresses at the expected rate,” argues Drury, who is among the top 3% of stock pros covered by TipRanks.

To support his view, Drury points to the astonishing pace of OpenAI’s subscriber growth – evidence that Nvidia’s partnership and broader AI investments are on solid footing.

This relentless demand for computing power is the linchpin of his bullish stance. Drury references a projection from Nvidia CEO Jensen Huang, who recently estimated that global data center capital expenditures could soar from $600 billion at the end of 2025 to between $3 trillion and $4 trillion by the decade’s close.

“This would lead to even more growth for Nvidia, making it a smart investment option now,” emphasizes Drury, noting that such a spending boom implies a 42% compound annual growth rate in AI capex over the next five years.

If Nvidia does manage to lift revenues by more than 40% in the coming year, Drury believes its current valuation – a 1-year forward P/E of 28x – looks inexpensive. Needless to say, that’s exactly how he expects things to unfold.

“I think 2026 will be similar to years past, making Nvidia an excellent stock to buy now,” concludes Drury.

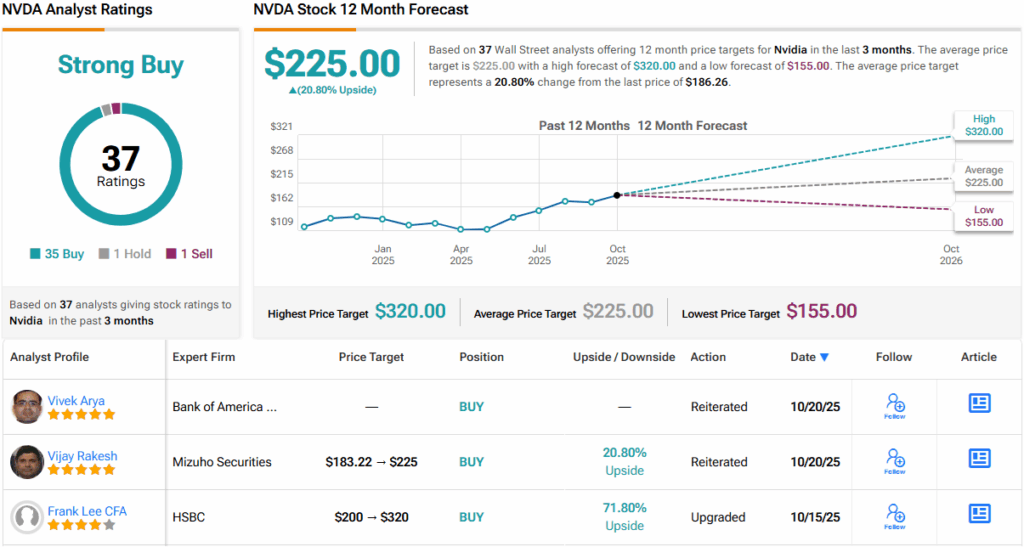

Nvidia remains as popular as ever on Wall Street as well. With 35 Buys far outshining 1 Hold and 1 Sell, NVDA boasts a Strong Buy consensus rating. Its 12-month average price target of $225 implies a potential upside just shy of 21%. (See NVDA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.